Expert Tips for Buying a Used Bike

Used bikes are great for many people . They’re inexpensive, easier to maintain than new bikes, and often provide better performance. However , the key to buy used bike is knowing what you’re looking for.

Here are some tips that can help you buy a used bike with confidence .

What to Look for in a Used Bike

There are lots of factors to consider when buying a used bike . You’ll have to weigh the pros and the cons of each bike. Here are some things to keep in mind.

- Age: The older the bike , the more work it may need .

- Size: Bikes can be different sizes. Make sure you know the size of your current bike before you shop .

- Quality: Bikes have different quality levels . Choose the best-quality bike you can afford.

How to Inspect a Used Bike

Before you buy a used bike , you need to inspect it carefully . Here are a few tips to help you inspect the bike before you buy it.

- Check the tires and brakes for wear .

- Look for cracks in the frame .

- Check the spokes and goner on the wheels .

- Check the chain and gears .

- Check the brakes, especially the pads. If they’re not in good shape , get a new set .

How to Buy a Used Bike

When buying a used bike , it helps to know what you’re buying . Here are some questions to ask the seller.

- How old is the bike ?

- Is it in good condition ?

- Is it missing parts ?

- Does it need repairs ?

- Will you have any problems getting replacement parts ?

Don’t Buy a Used Bike Without a Test Ride

Even though you have a lot of knowledge , you can’t really know how well a bike will perform until you test ride it . So test ride the bike before you buy it.

Dress comfortably for the test ride . If you want to test mountain bikes , wear a helmet and a long-sleeved shirt. Wear sandals or shorts if you’re trying road or hybrid bikes. Then ride your bike for at least 20 minutes.

If you notice any problems with your bike during the test ride , tell the seller about it and ask them to fix it before you buy it .

Take the Time to Check the Frame and Especially the Wheels

Inspecting the bike’s frame and wheels is critical to finding potential problems with an old bike .

The frame is the frame of a bike . It connects the saddle to the handlebars and supports the wheels and tires. Look for cracks or weak spots on the frame. Also look for dents in the tubing of the frame or cracks at the welds that join the frame together.

Check the wheels and tires for cracks or other problems as well . If the tire tubes are bulged , replaced them immediately.

See also: How We Tested the Best Road Bikes

Look at the Saddle and Handlebar Stem

Evaluate the saddle and the handlebar stem before you buy the bike . The handlebar stem is the part of the handlebars that connect to the handlebar grips. The saddle is the part of the bicycle that you sit on while riding.

The saddle should be comfortable. Test the saddle by sitting on it for at least 10 minutes in a store .

The handlebar stem should be straight and fit snugly in the handlebar clamps. There should be no play in the handlebar stem . If the handlebar stem wobbles when you pedal , get a new handlebar stem.

Check the Brakes

Bicycles have two kinds of brakes: rim brakes and disc brakes. Rim brakes are the kind you’ll find on older bikes . Disc brakes are the newer kind and work better in wet weather and on slippery roads.

Look for problems with the brake pads . Also look at the brake levers to make sure that the brake levers don’t bind when you squeeze them.

Check the Tires

You should check the tires before you ride the bike to make sure they’re in good shape . Look for cracks in the sidewalls or bulges in the tires. Also check to make sure the tires are inflated properly.

If you can’t change the tires yourself, ask the seller to change them . If the tires are old or badly worn , replace them before you ride the bike.

Look at the Chain , Gears, and Brakes

A bike’s chain and gears transmit power from the pedals to the wheels. A good bike chain should run smoothly when you pedal . Gears should be smooth and free of any oil or buildup.

Inspect the brake pads on the front and rear wheels. They should be free from dirt and debris and be in good condition. Also inspect and lubricate the brake cables , which connect to the brake levers .

Look for problems with the brake levers and cables. If the brake levers bind when you squeeze them , replace them .

Check the Pedals

Look for problems with the pedals and pedals’ cleats. Make sure the pedals’ bolts are tight and that the cleats are securely fastened to the bike . Also make sure the pedals’ pins are secure , which keeps them attached to the pedals.

Beat the Crowd When Investing in Real Estate

Crowd investing is a popular choice for real estate investors because it allows individuals to invest in a property without having to front the full cost. Crowd investing platforms connect interested investors with properties that they can purchase together. This allows individual investors to share the risk and reap the rewards of increased demand for a particular property.

The popularity of crowd investing has led to a surge in real estate prices around the world. In some cases, this has resulted in over-valuation of properties, but it has also allowed more people to invest in real estate than ever before. Crowd investing provides an affordable way for individuals to get into the real estate market and make money while the market is still growing.

The Pros of Crowd Investing:

Crowd investing is a relatively new phenomenon in the world of real estate. It refers to the act of raising money by selling securities to a large number of people, often through the internet or other electronic means. The pros of crowd investing are manifold.

First and foremost, it is an efficient way to raise money. Crowd investors are able to get in and out of investments quickly, making it ideal for those looking for short-term returns. This flexibility also makes it well-suited for high-growth opportunities.

Second, crowd investing allows investors to diversify their portfolios in a cost-effective manner. By buying securities from multiple companies or projects, investors can reduce the overall risk they take on when investing in real estate.

Third, crowd investing offers potential investors access to quality investments that may not be available through traditional channels.

The Cons of Crowd Investing:

Crowd investing is all the rage these days. But before you rush into it, be aware of the cons associated with this type of investment. First and foremost, crowd investing is highly risky. You could lose your entire investment if the project fails. Second, there’s no guarantee that the project will generate a return on your investment. Third, you may not have access to information about the project that other investors do. Finally, crowd investing can be difficult to track and monitor. If you’re considering crowd investing as an option for your real estate investments, be sure to do your homework first!

How to Beat the Crowd When Investing in Real Estate:

If you’re looking to invest in real estate, there are a few things you should keep in mind. First and foremost, research the area you’re interested in. Second, don’t be afraid to wait for the right property. And finally, remember to stay organized and take the time to understand the market—no matter how crowded it seems.

When it comes to location, no one beats Newport Plaza Singapore. This mixed-use development offers luxurious apartments as well as retail spaces and amenities such as a gym and pool. The property also has an amazing view of Marina Bay Sands and Singapore’s iconic skyline.

Of course, not everyone can afford Newport Plaza Singapore—nor should they try. But there are plenty of other great locations available for those who are willing to do their homework and wait for the right opportunity.

Buying a Condo Versus Buying a Home

When it comes to buying a home, one of the main decisions you’ll need to make is whether to buy a condo or a single-family home. Both options have their own unique benefits and drawbacks, and the right choice for you will depend on your needs, budget, and lifestyle. Here’s a closer look at the thiam siew new launch the continuum:

Pros of buying a condo:

- Lower cost: One of the main advantages of buying a condo is that they tend to be more affordable than single-family homes. This can make them a good option for first-time buyers or those on a tight budget.

- Lower maintenance: Condos often have lower maintenance costs than single-family homes, as the association fees typically cover things like landscaping, exterior maintenance, and common area upkeep. This can be a big advantage for those who don’t have the time or inclination to do these tasks themselves.

- Amenities: Many condos come with a variety of amenities such as pools, fitness centers, and common areas, which can be a great feature for those who enjoy an active lifestyle.

- Security: Condos often have added security measures such as gated entrances and on-site security staff, which can be a plus for those who value peace of mind.

Cons of buying a condo:

- Limited privacy: One of the main drawbacks of buying a condo is that you’ll have less privacy than you would in a single-family home. You’ll be living in close proximity to your neighbors, and you may have shared walls, floors, or ceilings.

- Association fees: Another potential drawback of buying a condo is that you’ll be required to pay association fees, which can add to your monthly expenses. These fees can vary significantly, so it’s important to understand what they cover and whether they represent a good value.

- Restrictions: Condos often have more restrictions than single-family homes, including rules and regulations governing things like pets, rentals, and modifications to the unit. These restrictions can impact your ability to enjoy the property and may affect its resale value.

- Financing: It can be more difficult to get approved for a mortgage to buy a condo than it is to buy a single-family home. This is because lenders tend to view condos as a higher risk due to the shared ownership structure and the potential for association financial issues.

Pros of buying a home:

- Privacy: One of the main advantages of buying a single-family home is that you’ll have more privacy than you would in a condo. You won’t have shared walls, floors, or ceilings, and you’ll have your own yard and outdoor space.

- Control: When you own a single-family home, you have more control over your living space and can make modifications and improvements as you see fit.

- Potential for appreciation: Single-family homes tend to appreciate in value more than condos, which can make them a good investment over the long term.

Cons of buying a home:

- Higher cost: One of the main drawbacks of buying a single-family home is that they tend to be more expensive than condos. This can make them less affordable for some buyers, especially in markets with high demand and rising prices.

- Higher maintenance: Single-family homes also tend to have higher maintenance costs than condos, as you’ll be responsible for all aspects of the property’s upkeep, including the landscaping, exterior maintenance, and repairs

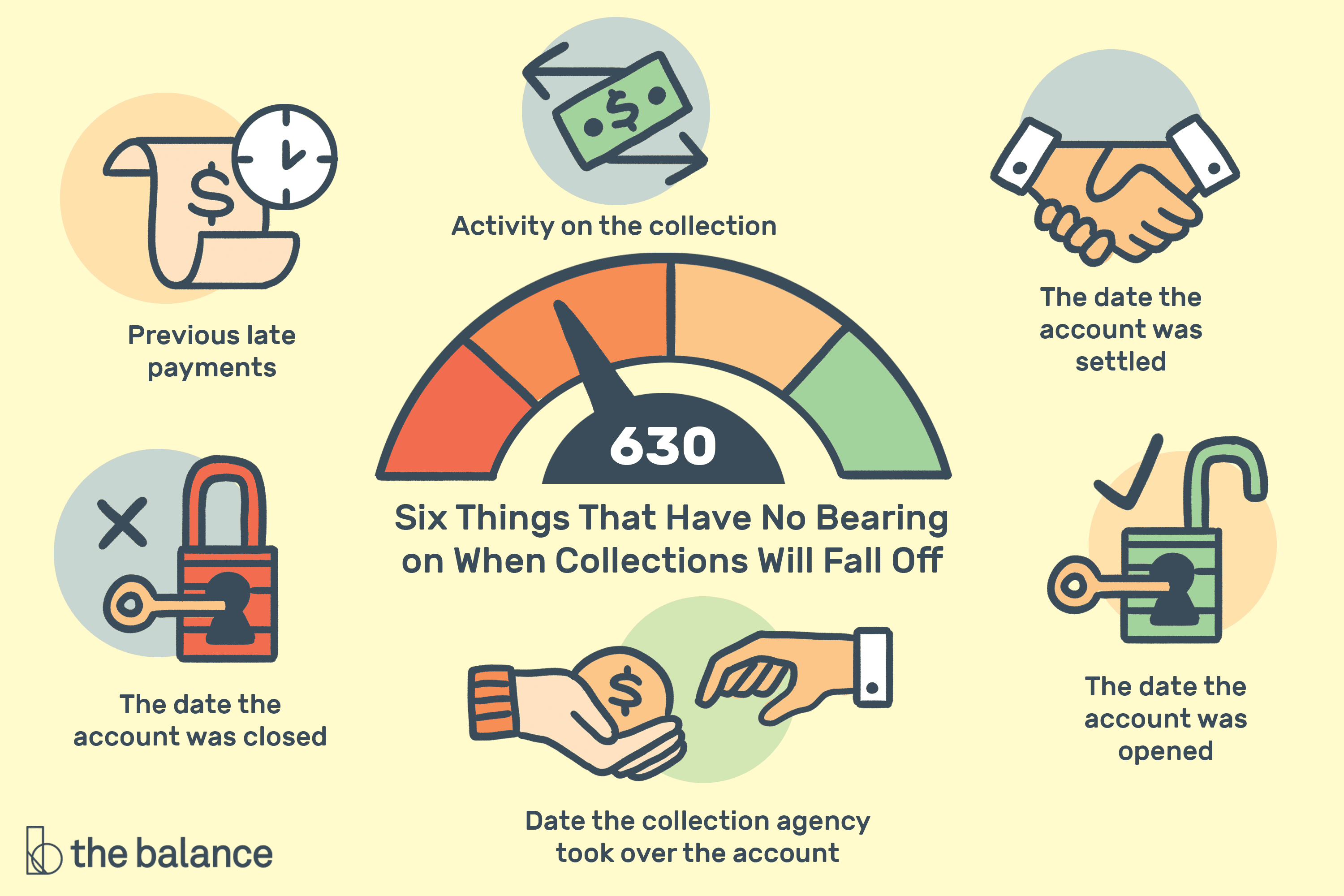

Tips For Successful Debt Collections

Debt Collection Overview

Debt collection is a complex process that involves a debt collection agency reclaiming money owed to them by an individual or business. It can be a daunting experience for those involved in the process, but with the right approach, it doesn’t have to be. Understanding the basics of debt collection will help ensure successful collections and improve relationships between creditors and debtors.

A debt collection agency typically begins with an initial contact letter to remind the debtor of their outstanding balance. This is often followed up by phone calls, emails and other communication methods as needed. During these conversations, it’s important to maintain professionalism with both parties and keep all communications clear and courteous in order to establish trust and goodwill between them. The goal is always to negotiate an agreement that works for both sides while minimizing conflict whenever possible.

Know Your Rights

Are you looking for tips on how to successfully collect debt? Knowing and understanding your rights when it comes to collections is the first step.

When a creditor is trying to collect a debt from you, they must follow certain laws and regulations. It is important that you know what these rules are so that you can protect yourself, as well as ensure that all parties involved in the process abide by them.

The Fair Debt Collection Practices Act (FDCPA) sets out clear guidelines for how creditors can interact with consumers who owe them money. This act provides protection from abusive practices such as harassment, threats of violence, or using false statements to obtain payment. It also ensures that creditors provide accurate information about the amount owed and give consumers an opportunity to dispute any inaccuracies before taking legal action.

Document Everything

Document Everything is a key step to successful debt collections. Through proper documentation, businesses can protect themselves from any potential legal issues that could arise with their debtors. Additionally, records of all communications and payments will provide helpful evidence should the need for litigation arise when settling unpaid debts.

Businesses should be aware of the importance of documenting every step during the collection process from initial contact with debtors through to settlement. This includes providing detailed notes about phone calls, emails, conversations and other interactions with customers. Records should also include payment history and receipts as proof that payments were received in full or for only a portion of the amount owed. All documents must be kept in an organized fashion and stored securely in case they are needed at a later date for evidence or dispute resolution purposes.

Utilize Technology

Utilizing technology is essential for any successful debt collection. In today’s digital world, businesses must have the right tools to ensure they get their money owed. Technology can help streamline operations and increase efficiency when it comes to collecting debts. With the right software program in place, debtors can be easily tracked and managed without having to manually search through physical records or paperwork. Additionally, technology eliminates human error that could lead to incorrect payments or miscommunication with debtors.

The first step for any business looking to implement a debt collection system is to research what type of software is available on the market today. Options range from simple programs designed for small businesses all the way up to larger platforms equipped with powerful analytics and data tracking capabilities. Once a suitable program has been chosen, companies should be sure to properly train employees on how to use it before implementation begins.

Stay Professional

When it comes to debt collections, staying professional is a key factor for success. It can be difficult to interact with people who owe you money and maintain a level of professionalism, but it’s essential for the process to work effectively. Following these tips will help ensure that you remain professional while still finding success in collecting your debts.

First and foremost, stay calm throughout the entire process. No matter how frustrated or upset customers may be, keeping an even temper will help them take you seriously and make them more likely to cooperate with you. Additionally, keep your conversations focused on the subject at hand–debt collection–and avoid bringing up other matters that could distract from the task at hand.

It’s also important to remain respectful while speaking with customers; don’t forget that they are human beings and should always be treated as such.

Be Consistent

Consistency is an important factor when it comes to successful debt collections. Companies that take the time to develop consistent processes, procedures, and policies can reduce the amount of time spent managing delinquent accounts while increasing their rate of return on investments.

When it comes to debt collections, setting up a consistent process for collecting payments should be the first step in any company’s strategy. Companies should create templates for customer collection letters, establish payment reminders and set up automatic payment processes with customers who are reliable payers. Also, they should make sure that all documentation related to payments and customer communication is properly filed and stored electronically so it can be easily referenced later on.

6 Steps To Choosing The Right Locksmith

There are a lot of things to consider when choosing a locksmith. You want to ensure that the locksmith is credible, has a good track record, and is affordable. You also want to make sure that the locksmith is available when you need them and can provide you with the services you need.

With so many things to consider, how do you choose the right locksmith?

1. Be Clear About the Locksmith Services You Need

There are many types of locksmith services, and not all locksmiths offer the same. A residential locksmith can help you with things like changing your locks, re-keying your home, or getting you into your house if you have locked yourself out.

Whereas a commercial locksmith can help you install new locks or security systems or get into your office if you have locked yourself out. Apart from these two, emergency locksmiths can come to your aid 24 hours a day, 7 days a week. Keeping all this in mind, before hiring anyone, ensure you know what you need and which type of locksmith is perfect for the job.

2. Find Out Who Can Provide the Service

When it comes to finding a Phoenix locksmith, it’s important to choose a reliable and experienced locksmith that can provide the services you need. Not all locksmiths are created equal, and some may not be able to provide the services you’re looking for.

First, consider what services you need. Do you need a locksmith for your home, business, or vehicle? Make sure to choose a locksmith specializing in the type of service you need. Next, check online reviews and see what others say about the services of that particular locksmith. This can help you narrow down your choices and find a reputable locksmith. Finally, you can get in touch with the locksmiths you finalize and ask more about pricing and availability. Be sure to get quotes from multiple locksmiths to compare prices and services.

3. Ask Which Locksmith Providers Are Covered

When it comes to finding a locksmith, it’s important to choose one that your insurance provider covers. Otherwise, you may be stuck with a bill for the full cost of the services. Ask your insurance agent or broker to find out which locksmith providers are covered. They should be able to provide you with a list of approved providers, and after that, you can start with the hiring process.

4. Get an Estimate for the Cost of Services

When you need the services of a locksmith, the final cost is an important factor to consider. You don’t want to overspend on a locksmith when you could have spent less on someone else. To get an estimate for the cost of services, you can contact a few different locksmiths in your area and ask for quotes.

When you compare the quotes, be sure to ask about any additional fees that may be included. Also, be sure to ask if the locksmith offers any discounts for seniors or military personnel. All this will give you an idea about the final cost associated with the work, and you can choose a professional with the cheapest and best service.

5. Request to See Credentials

When choosing a locksmith, be sure to see their credentials. A professional locksmith must have the proper licenses, insurance, or other relevant documentation. This will ensure that the locksmith is qualified to do the job, and you will be protected in case of any damages. An experienced locksmith will also be able to handle any unforeseen situation that may come up during the job and may save you a lot of time and money as well.

They will also be able to give you advice on what type of lock is best for your home or business. When requesting to see credentials, be sure to ask for references as well. A good locksmith will have no problem providing you with a list of satisfied customers. This will give you peace of mind knowing that you are dealing with a trustworthy and reliable professional.

6. Get an Invoice for the Locksmith Services

A good way to make sure you’re choosing the right locksmith is to get an invoice for the services. This will give you a breakdown of what the locksmith will be doing and how much it will cost. You can then request the locksmith to give you a discount and remove any unnecessary services that they might have included in the invoice.

What to Avoid When Hiring a Locksmith

When it comes to choosing a locksmith, there are a few things you’ll want to avoid. First, be sure to avoid any locksmiths who don’t have a physical address. This could mean they’re not reputable and could even be scammers. If possible, you can go through the locksmith’s website which is a good indicator of the service quality as well.

Second, avoid any locksmiths who give you a quote over the phone without seeing the job first. This is likely an estimate that’s much higher than what you’ll actually end up paying. Finally, avoid any locksmiths who require payment upfront before any work is done. A reputable locksmith will only request payment once the job is completed to your satisfaction.

What Are Payday Loan? Who Can Take The Loans?

The term “payday loans” is not something that you want to hear, and it can be very difficult to understand why people are so obsessed with these loans. While they may seem like a good idea at first, there is always the danger of falling into debt, which will only get worse if you do not pay off your loan when due.

Before we go into detail about payday loans, let us try and make sure you understand what these loans are all about. If you still do not have a clear understanding of what they are, then this article is for you.

What Are Payday Loans?

These types of loans are also called cash advances or paycheck advance loans. The name is misleading because they are not loans from banks or other financial institutions, but instead, they are small-time personal financing solutions that are offered by private companies. These companies give out quick cash to their customers in exchange for some collateral, such as an automobile title or a house deed. They are also known as “short term loans” because they are supposed to help you tide over short-term financial problems without causing too much trouble.

There are usually two kinds of payday lenders: small-dollar lenders and big-dollar ones. Small-dollar lenders have limited funds and therefore cannot offer large amounts of money. Big-dollar lenders, on the other hand, deal with larger sums of money and thus have more opportunities to expand their loan offerings.

If you think about it, it makes sense that such lenders would need to specialize in different areas. For example, a person who needs $1,000 in order to cover medical expenses for his family might choose to borrow from a small-dollar lender, while someone who needs $20,000 to start up a business venture might prefer to work with a big-dollar lender.

As long as you qualify for a payday loan, which means that you are able to provide proof of income and sufficient assets (such as a car), you should be fine. The amount you need to borrow depends upon how much you earn and how much you need right away.

Most lenders require borrowers to use a form of credit score – such as FICO scores – before approving a loan request. This helps them determine whether or not it is safe to lend money to each individual customer based on their history of paying back previous debts.

Who Can Get Payday Loans?

Payday loans are open to anyone who has been employed for at least six months and has either worked full time or is self-employed. In addition, you must be older than 18 years old.

In most cases, you cannot borrow more than $500 in one day. However, in many states, you can borrow up to twice the limit if you have a valid driver’s license or state ID card. Also, many payday lenders allow you to withdraw the money in increments of less than $25, meaning that you only need to repay a maximum of $50 per week. Many lenders also allow you to spread out your payments over several weeks or even months.

You can only apply for a payday loan once every 14 days. Once you get approved, the repayment process usually takes between two and three days. As soon as you receive the cash, you need to deposit it into your bank account. It is important to keep in mind that these loans have high interest rates. The average APR rate for payday loans is 400 percent!

Why Do People Take Payday Loans?

It is easy to see why the majority of Americans take payday loans. After all, it is a simple solution to a complex problem. Most people do not have enough savings to cover emergency spending, especially if they experience unexpected expenses.

Another reason is that some people do not have access to traditional banking services. A lot of payday lenders offer their services at places where you can easily walk in and get a small loan. This makes it easier for those who do not have bank accounts or any other type of credit rating to get access to financing.

Payday loans are also popular with the college student population. Most students have no savings and therefore rely heavily on their parents to finance their education. They often find it hard to save money for tuition fees and living costs, so they turn to payday loans to cover their monthly bills. Even though these students may end up failing classes and being expelled from school, they simply cannot afford to leave until they have paid off their loans. Thus, they end up taking out even more loans and accumulating even bigger debts.

People also take out payday loans when they run out of money during a period of unemployment. They are desperate and do not know how else to handle the situation. Some of them even resort to borrowing from friends and relatives just to stay afloat. All of this leads to a vicious cycle.

People plan to choose the pay day loan as they are easily available on various online sites. A person can easily borrow money online as they are a good option that will give them with good results. The main motive of people is to choose the option that will give them with good results. Online burrowing of the funds is the convenient option as they provide an option to save time.

What Happens If You Do Not Pay Back Your Loan On Time?

When you sign up for a payday loan, you agree to pay back the entire sum within 30 days. If you fail to meet this deadline, you will face a penalty fee of $15-$35, depending on the specific terms of the loan agreement. This fee will be added to your existing balance, making it even harder to pay back your loan completely.

If you don’t settle up with your lender on time, there is another option. There are many payday loan collection agencies that specialize in collecting overdue debt. They charge a substantial fee for their services, but they can also report your failure to repay to credit bureaus, which could result in permanent damage to your credit record.

This is why it is important to follow the repayment schedule outlined by your lender. In most cases, they will send reminders to you every two weeks. If you fail to respond to them, they may ask you to pay an additional fee. If you do not comply, they may pursue legal action against you.

How Does Payday Loans Affect Your Credit Score?

One of the reasons why most people end up taking out payday loans is that they believe that this is the fastest way to improve their credit score. Unfortunately, this belief is false. The truth is that payday loans lower your overall credit score because they are considered non-reversible transactions. Once you fail to repay your loan, you won’t ever be able to recover the money you owe and get your funds back.

What Are The Various Methods Of Doing The Shopping On Special Occasion Of Christmas?

There is nothing more frustrating than trying to buy a gift and not knowing what to get. If you’re in this situation, this article has some great ideas that will help you out.

If you are looking for an easy way to come up with ideas for Christmas gifts then these three suggestions might just be the answer you need. They can also work for birthdays and any other occasion where you may have trouble finding something for the person on your shopping list!

1. Go Shopping With A Gift Card

We all know that buying a gift card is a good idea when it comes to getting someone exactly what they want. This applies to both men and women as well as adults and children. When you are going to purchase a gift card, try not to do it at the same time that you are shopping for the actual item. It will make things much easier. You can go online and find many different sites that offer gift cards.

When you make the decision to purchase a gift card from one of those stores, make sure that you choose the right one. The best thing to do is to look at the various options available and go through buying guides like the one on Antena3.ro for a better understanding. Thereafter, you can choose one that will match the price tag that you are paying. Many people like to use their credit or debit cards to pay for gift cards. It makes the process of obtaining the card simple and straightforward.

2. Use Your Own Personal Stash Of Money To Pay For Gifts

In addition to using a gift card, there is another way that you can save money to give as a gift without having to spend any of your own funds. All you really have to do is to look around in your own home to see what you have lying around that could be used instead of cash. There are certain items that you might already have that would make great presents if you were able to wrap them up and give them away. These types of items include toys that you don’t play with anymore, old clothing, books, and even tools that you no longer use.

It is important that you look through your personal stash of stuff to find the perfect gift. Be creative and really think about what you might be able to find somewhere else besides in your closet. As long as it fits into the budget that you have set, it should be perfect for the person who receives it.

3. Research What Others Are Giving Their Friends And Family

The final option that we would like to discuss involves researching what others are giving their friends and family members. Once again, this can apply to both males and females as well as adult and child. In order to research this type of information, you will need to start by making a list of everyone who lives in your household. Make sure that you include everyone whom you might possibly give a gift to. After you have compiled your list, do your homework.

Once you have done your research, pick out the top five or ten gifts that you feel will be the most appropriate. Then write down how many of each you think that each person would actually like. Keep track of everything, but if you notice that you are running low on supplies, stop and ask around to see if anyone has extra items that they aren’t using. If so, you can swap it with someone else on your list. This is a great way to ensure that you always have plenty of goodies to put under the tree.

With these three tips, you will never have trouble coming up with the perfect gift for someone on your holiday shopping list. Just remember that you can only give what you have and you won’t disappoint any of your loved ones.

Everything You Need To Know About Wells Fargo Card Activation

Many of you must have opened the account with Wells Frago? If yes then surely you must be thinking that is there any information of credit card also situated with the account too? If this is your question or the dilemma you carry in mind then surely down below are given some points which can provide you the best answer to your question or clear your dilemma with ease.

Here is the guide that will teach you step by step about the activation of your Wells Frago account.

To get your debit or charge card account you should follow these measures and actively follow these steps so that it can help you get the activation of your debit card or charge card done through internet, any ATM of Wells Frago or just by a phone call. Now just imagine how easy it is to get your activation done in your own suitable and possible way with the help of Wells Frago activation guide.

Here are some of the quick tips for you before activating you Wells Frago card. These tips are really helpful for you as a customer and it can help you in learning the follow steps of guide to activate your card in which you can do the activation process with ease without making any mistakes.

Sometimes it happens with consumer that consumer do search for online activation process but they are not aware about which card holder they are so this make the activation process difficult for them. But when its about consumer satisfaction we always keep n mind that our content should be helpful to them in all ways. That’s why we are n this guide providing you the complete information about the activation of your WF card so that you can do the activation in right way and can understand the terms of online management too.

Here is the list of contents which you will discover in this guide for learning the best step by step activation process of your WF card.

Quick Tips before learning the step by step guide

Activation of WF Card can be done even online by just visiting Wellsfrago.com/Activate

If you wish to get activation done on phone through official number then you are just one ring away, dial 1-877-294-6993 for your WF Card activation

Just reach your nearby ATM and you can get your card activation done.

The details and credentials are kept private by the bank and shared with the right person only not any other person or with everyone.

Methods for activating Wells Frago Card: A step by step guide and solution for consumers.

Even though the WF card activation can be done by the phone call, online process and reaching nearby ATM still here is the full guide of activation process for the customers to understand the activation step by step with ease.

- Internet Activation of Wells Frago Credit Card

- Required Username and Password

- Wells Frago credit card banking system online login.

- Don’t have the existing account? Can set up a new one

- Getting new credit card through WF Card activation online portal

- You can still sign up to manage your Wells Fargo accounts online.

- All you will need is your credit card number, your email address, and some kind of identification.

- On call Wells Frago Card activation process

For the activation of your debit card you can dial the number 1-877-294-6933. But make sure you dial the number from your registered mobile or linked telephone to get the activation process right.

Telecaller will connect to you on the same line and as a customer you have to provide the telecaller the right details of your cards for activation.

Just follow the instructions given by the telecaller and complete the full process and your card will be activated through phone process in less than one minute.

WF card activation through the process of WF ATM’s

Carry your card in hand when you are thinking to activate your card in Wells Frago ATM. To do the activation of WF card at WF ATM one also need to get the card consumer number at the time of activation which will help in completing the process.

- Visit the nearby WF ATM

- Just enter or swipe your WF debit card in ATM machine.

- Instructions will appear on screen follow them and do the process of making new card

- Enter your PIN and complete the process by following the rest of the instructions.

- Does every WF Credit Card has the same visa features in it?

It solely depends on the back logo of the card. If your card has the logo of credit behind it then surely you can make purchases to the new credit line and avail credit card features and benefits on your WF card.

Are you waiting for your card to arrive? Here what one needs to do?

Well surely it gives the consumer much tension if the waiting period jumps over the usual period. If you have applied for WF Credit Card and have been selected for it even after the selection if the tenure of days is above than 21 days then surely it is important to make a call to your lender. Just connect with WF Card customer care number and call between business hours only from Monday to Friday to get an assistance on your card delivery.

Its bit different activating your new WF Debit card then the usual one. Here what one needs to know about the activation process?

One person can easily activate their new WF Debit Card with WF ATM or helpline number. If one is unable to go to ATM then phone activation is the best way to activate your new Debit card as you cans simply call the helpline number that is 1- 877- 294- 6933 from your registered phone and can get the activation done in a minute by following the process given as instruction by the lender. But if you think call is not what you wishing then go to the WF ATM and use your card in ATM machine and the pin number will be mailed to you separately so you

Interest Free Balance Transfer Credit Card Options

A ton of information continually circulates about an interest free balance transfer credit card but sorting through truths and untruths can be somewhat challenging. Therefore, we wanted to take this opportunity to provide facts about a credit card such as this, helping you determine if this would be the right solution for you or if another type of card would work better.

First, an interest free balance transfer credit card is a card that has 0% interest, but only for a specific amount of time known as the introduction or introductory period. Second, this type of card does not cost anything to transfer balances from other credit cards. These two things combined result in a unique credit card that could save you significant money but only if the card is from a reputable company and all the terms are clearly outlined and understood.

Of course, the balance transferred from the higher interest rate card to the interest free balance transfer credit card would still have to be paid off in full but the benefit is that during the period when no interest is charged, all of the money would go toward the principle. As the old card is closed, it would be reported as positive to the three reporting credit bureaus that it was paid off early and for the full amount. As long as the balance on the new card is aggressively paid, it too could be reported positively.

In most cases, financial institutions and credit card companies that offer an interest free balance transfer credit card are honest and reputable. These companies work hard to provide consumers with exceptional value that also benefits them. However, some companies use offers for a credit card such as this more as a teaser. This means they market the card in a way that encourages people to apply but important terms are carefully hidden that decrease the card’s value.

A great example would be a company offering an interest free balance transfer credit card in a way that makes it look like the perfect solution for everyone. Unfortunately, if you were to dig deeper, you would find the introductory period when no interest is charged is short, meaning you have little time to pay enough down on the balance to make a difference and warrant switching cards.

If you want an interest free balance transfer credit card to work for you, it is essential that the transferred balance be paid off as quickly as possible. If you were to make only minimum payments, the concept of 0% interest during the introductory period would be a wasted opportunity for getting out of debt.

Bankamericard Power Rewards Visa Signature Credit Card

If you have excellent credit and want a credit card that offers low interest, low fees, and a variety of benefits, the BankAmericard Power Rewards Visa Signature credit card would be an ideal choice. Interestingly, Bank of America has a long history, not just for being an outstanding financial institution, but also for taking one of the more innovative approaches in introducing the public to its new BankAmericard credit card.

In 1958, 60,000 unsolicited credit cards were mass produced and mailed to people within Fresno California. The concept of drop was quite interesting and had its targeted more of the right people the project would likely have been successful. Unfortunately, it was thought the result of this project would be account delinquency of no more than 4% but it shot up to 22%. Obviously, the Bank of America has made significant changes over the years and as a result, they now offer consumers with a variety of credit card options.

One popular BankAmericard credit card is the Power Rewards Visa Signature. With this, once you make $100 in purchases using the card during the first 60 days, a $50 credit would be applied to your statement. In addition, you would earn three points for every $1 spent on groceries, drugstore items, and gasoline during the first six months and then one point per every $1 thereafter on all other purchases. Once the points have accumulated, they could be redeemed for cash, hotel accommodations, rental cars, merchandise, gift certificates, travel experiences, and travel with no blackout dates.

Rewards on the BankAmericard Power Rewards Visa Signature credit card could be enjoyed after 2,500 have been accumulated. In addition, points have no limitation as to how many can accumulate within a 12-month period. Another benefit to this credit card is the introductory period, which offers 0% Annual Percentage Rate over a 7-month period for standard purchases and a 12-month period for balance transfers. Once the initial offer expires, interest would be established between 12.99% to 20.99% variable for both purchases and balance transfers.

Keep in mind, the BankAmericard Power Rewards Visa Signature credit card is just one of the many excellent offers through the Bank of America. However, for an all-purpose credit card that has outstanding benefits, this one is hard to beat. Therefore, we recommend you consider it when you get ready to start applying.