Month: December 2022

Expert Tips for Buying a Used Bike

Used bikes are great for many people . They’re inexpensive, easier to maintain than new bikes, and often provide better performance. However , the key to buy used bike is knowing what you’re looking for.

Here are some tips that can help you buy a used bike with confidence .

What to Look for in a Used Bike

There are lots of factors to consider when buying a used bike . You’ll have to weigh the pros and the cons of each bike. Here are some things to keep in mind.

- Age: The older the bike , the more work it may need .

- Size: Bikes can be different sizes. Make sure you know the size of your current bike before you shop .

- Quality: Bikes have different quality levels . Choose the best-quality bike you can afford.

How to Inspect a Used Bike

Before you buy a used bike , you need to inspect it carefully . Here are a few tips to help you inspect the bike before you buy it.

- Check the tires and brakes for wear .

- Look for cracks in the frame .

- Check the spokes and goner on the wheels .

- Check the chain and gears .

- Check the brakes, especially the pads. If they’re not in good shape , get a new set .

How to Buy a Used Bike

When buying a used bike , it helps to know what you’re buying . Here are some questions to ask the seller.

- How old is the bike ?

- Is it in good condition ?

- Is it missing parts ?

- Does it need repairs ?

- Will you have any problems getting replacement parts ?

Don’t Buy a Used Bike Without a Test Ride

Even though you have a lot of knowledge , you can’t really know how well a bike will perform until you test ride it . So test ride the bike before you buy it.

Dress comfortably for the test ride . If you want to test mountain bikes , wear a helmet and a long-sleeved shirt. Wear sandals or shorts if you’re trying road or hybrid bikes. Then ride your bike for at least 20 minutes.

If you notice any problems with your bike during the test ride , tell the seller about it and ask them to fix it before you buy it .

Take the Time to Check the Frame and Especially the Wheels

Inspecting the bike’s frame and wheels is critical to finding potential problems with an old bike .

The frame is the frame of a bike . It connects the saddle to the handlebars and supports the wheels and tires. Look for cracks or weak spots on the frame. Also look for dents in the tubing of the frame or cracks at the welds that join the frame together.

Check the wheels and tires for cracks or other problems as well . If the tire tubes are bulged , replaced them immediately.

See also: How We Tested the Best Road Bikes

Look at the Saddle and Handlebar Stem

Evaluate the saddle and the handlebar stem before you buy the bike . The handlebar stem is the part of the handlebars that connect to the handlebar grips. The saddle is the part of the bicycle that you sit on while riding.

The saddle should be comfortable. Test the saddle by sitting on it for at least 10 minutes in a store .

The handlebar stem should be straight and fit snugly in the handlebar clamps. There should be no play in the handlebar stem . If the handlebar stem wobbles when you pedal , get a new handlebar stem.

Check the Brakes

Bicycles have two kinds of brakes: rim brakes and disc brakes. Rim brakes are the kind you’ll find on older bikes . Disc brakes are the newer kind and work better in wet weather and on slippery roads.

Look for problems with the brake pads . Also look at the brake levers to make sure that the brake levers don’t bind when you squeeze them.

Check the Tires

You should check the tires before you ride the bike to make sure they’re in good shape . Look for cracks in the sidewalls or bulges in the tires. Also check to make sure the tires are inflated properly.

If you can’t change the tires yourself, ask the seller to change them . If the tires are old or badly worn , replace them before you ride the bike.

Look at the Chain , Gears, and Brakes

A bike’s chain and gears transmit power from the pedals to the wheels. A good bike chain should run smoothly when you pedal . Gears should be smooth and free of any oil or buildup.

Inspect the brake pads on the front and rear wheels. They should be free from dirt and debris and be in good condition. Also inspect and lubricate the brake cables , which connect to the brake levers .

Look for problems with the brake levers and cables. If the brake levers bind when you squeeze them , replace them .

Check the Pedals

Look for problems with the pedals and pedals’ cleats. Make sure the pedals’ bolts are tight and that the cleats are securely fastened to the bike . Also make sure the pedals’ pins are secure , which keeps them attached to the pedals.

Beat the Crowd When Investing in Real Estate

Crowd investing is a popular choice for real estate investors because it allows individuals to invest in a property without having to front the full cost. Crowd investing platforms connect interested investors with properties that they can purchase together. This allows individual investors to share the risk and reap the rewards of increased demand for a particular property.

The popularity of crowd investing has led to a surge in real estate prices around the world. In some cases, this has resulted in over-valuation of properties, but it has also allowed more people to invest in real estate than ever before. Crowd investing provides an affordable way for individuals to get into the real estate market and make money while the market is still growing.

The Pros of Crowd Investing:

Crowd investing is a relatively new phenomenon in the world of real estate. It refers to the act of raising money by selling securities to a large number of people, often through the internet or other electronic means. The pros of crowd investing are manifold.

First and foremost, it is an efficient way to raise money. Crowd investors are able to get in and out of investments quickly, making it ideal for those looking for short-term returns. This flexibility also makes it well-suited for high-growth opportunities.

Second, crowd investing allows investors to diversify their portfolios in a cost-effective manner. By buying securities from multiple companies or projects, investors can reduce the overall risk they take on when investing in real estate.

Third, crowd investing offers potential investors access to quality investments that may not be available through traditional channels.

The Cons of Crowd Investing:

Crowd investing is all the rage these days. But before you rush into it, be aware of the cons associated with this type of investment. First and foremost, crowd investing is highly risky. You could lose your entire investment if the project fails. Second, there’s no guarantee that the project will generate a return on your investment. Third, you may not have access to information about the project that other investors do. Finally, crowd investing can be difficult to track and monitor. If you’re considering crowd investing as an option for your real estate investments, be sure to do your homework first!

How to Beat the Crowd When Investing in Real Estate:

If you’re looking to invest in real estate, there are a few things you should keep in mind. First and foremost, research the area you’re interested in. Second, don’t be afraid to wait for the right property. And finally, remember to stay organized and take the time to understand the market—no matter how crowded it seems.

When it comes to location, no one beats Newport Plaza Singapore. This mixed-use development offers luxurious apartments as well as retail spaces and amenities such as a gym and pool. The property also has an amazing view of Marina Bay Sands and Singapore’s iconic skyline.

Of course, not everyone can afford Newport Plaza Singapore—nor should they try. But there are plenty of other great locations available for those who are willing to do their homework and wait for the right opportunity.

Buying a Condo Versus Buying a Home

When it comes to buying a home, one of the main decisions you’ll need to make is whether to buy a condo or a single-family home. Both options have their own unique benefits and drawbacks, and the right choice for you will depend on your needs, budget, and lifestyle. Here’s a closer look at the thiam siew new launch the continuum:

Pros of buying a condo:

- Lower cost: One of the main advantages of buying a condo is that they tend to be more affordable than single-family homes. This can make them a good option for first-time buyers or those on a tight budget.

- Lower maintenance: Condos often have lower maintenance costs than single-family homes, as the association fees typically cover things like landscaping, exterior maintenance, and common area upkeep. This can be a big advantage for those who don’t have the time or inclination to do these tasks themselves.

- Amenities: Many condos come with a variety of amenities such as pools, fitness centers, and common areas, which can be a great feature for those who enjoy an active lifestyle.

- Security: Condos often have added security measures such as gated entrances and on-site security staff, which can be a plus for those who value peace of mind.

Cons of buying a condo:

- Limited privacy: One of the main drawbacks of buying a condo is that you’ll have less privacy than you would in a single-family home. You’ll be living in close proximity to your neighbors, and you may have shared walls, floors, or ceilings.

- Association fees: Another potential drawback of buying a condo is that you’ll be required to pay association fees, which can add to your monthly expenses. These fees can vary significantly, so it’s important to understand what they cover and whether they represent a good value.

- Restrictions: Condos often have more restrictions than single-family homes, including rules and regulations governing things like pets, rentals, and modifications to the unit. These restrictions can impact your ability to enjoy the property and may affect its resale value.

- Financing: It can be more difficult to get approved for a mortgage to buy a condo than it is to buy a single-family home. This is because lenders tend to view condos as a higher risk due to the shared ownership structure and the potential for association financial issues.

Pros of buying a home:

- Privacy: One of the main advantages of buying a single-family home is that you’ll have more privacy than you would in a condo. You won’t have shared walls, floors, or ceilings, and you’ll have your own yard and outdoor space.

- Control: When you own a single-family home, you have more control over your living space and can make modifications and improvements as you see fit.

- Potential for appreciation: Single-family homes tend to appreciate in value more than condos, which can make them a good investment over the long term.

Cons of buying a home:

- Higher cost: One of the main drawbacks of buying a single-family home is that they tend to be more expensive than condos. This can make them less affordable for some buyers, especially in markets with high demand and rising prices.

- Higher maintenance: Single-family homes also tend to have higher maintenance costs than condos, as you’ll be responsible for all aspects of the property’s upkeep, including the landscaping, exterior maintenance, and repairs

Tips For Successful Debt Collections

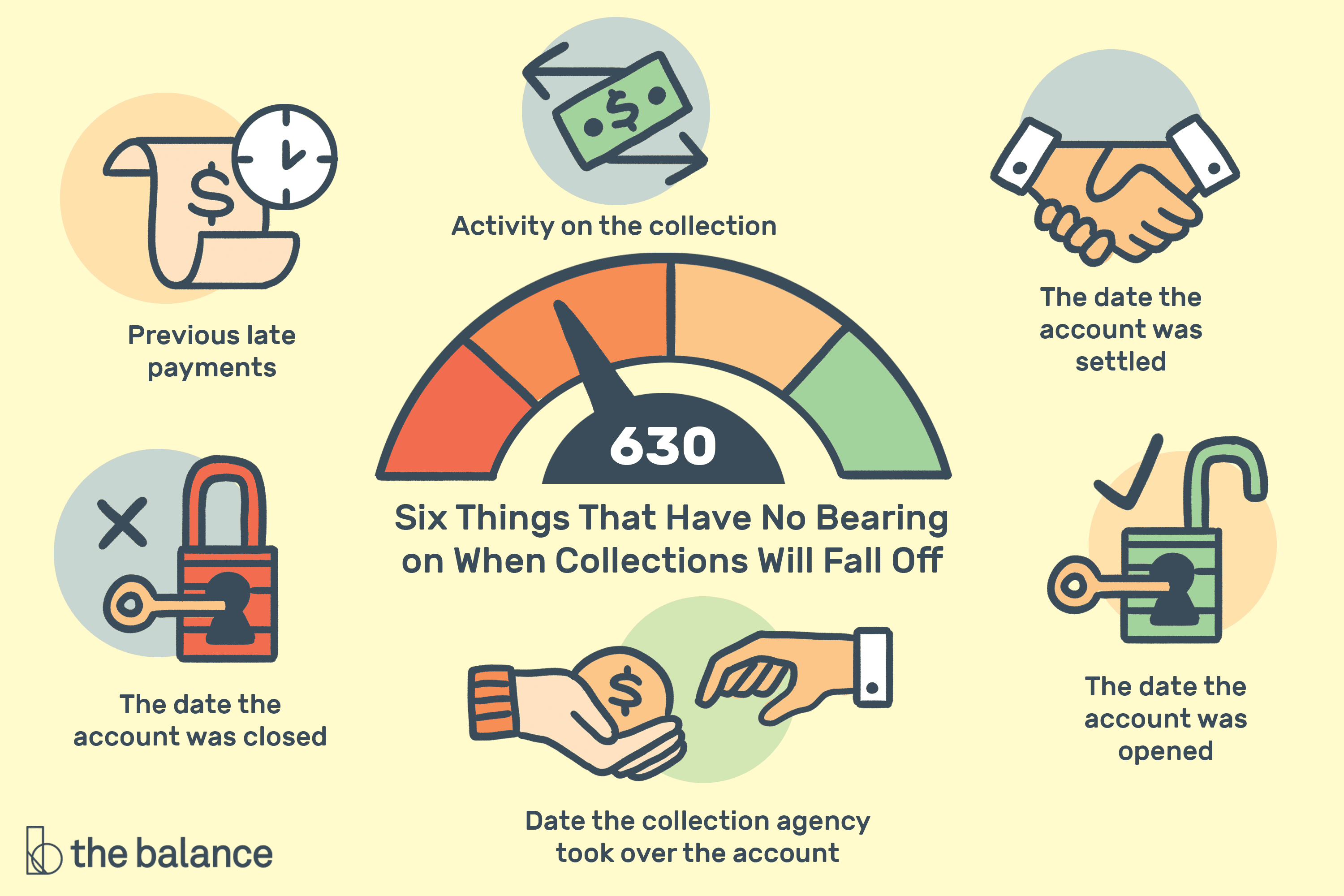

Debt Collection Overview

Debt collection is a complex process that involves a debt collection agency reclaiming money owed to them by an individual or business. It can be a daunting experience for those involved in the process, but with the right approach, it doesn’t have to be. Understanding the basics of debt collection will help ensure successful collections and improve relationships between creditors and debtors.

A debt collection agency typically begins with an initial contact letter to remind the debtor of their outstanding balance. This is often followed up by phone calls, emails and other communication methods as needed. During these conversations, it’s important to maintain professionalism with both parties and keep all communications clear and courteous in order to establish trust and goodwill between them. The goal is always to negotiate an agreement that works for both sides while minimizing conflict whenever possible.

Know Your Rights

Are you looking for tips on how to successfully collect debt? Knowing and understanding your rights when it comes to collections is the first step.

When a creditor is trying to collect a debt from you, they must follow certain laws and regulations. It is important that you know what these rules are so that you can protect yourself, as well as ensure that all parties involved in the process abide by them.

The Fair Debt Collection Practices Act (FDCPA) sets out clear guidelines for how creditors can interact with consumers who owe them money. This act provides protection from abusive practices such as harassment, threats of violence, or using false statements to obtain payment. It also ensures that creditors provide accurate information about the amount owed and give consumers an opportunity to dispute any inaccuracies before taking legal action.

Document Everything

Document Everything is a key step to successful debt collections. Through proper documentation, businesses can protect themselves from any potential legal issues that could arise with their debtors. Additionally, records of all communications and payments will provide helpful evidence should the need for litigation arise when settling unpaid debts.

Businesses should be aware of the importance of documenting every step during the collection process from initial contact with debtors through to settlement. This includes providing detailed notes about phone calls, emails, conversations and other interactions with customers. Records should also include payment history and receipts as proof that payments were received in full or for only a portion of the amount owed. All documents must be kept in an organized fashion and stored securely in case they are needed at a later date for evidence or dispute resolution purposes.

Utilize Technology

Utilizing technology is essential for any successful debt collection. In today’s digital world, businesses must have the right tools to ensure they get their money owed. Technology can help streamline operations and increase efficiency when it comes to collecting debts. With the right software program in place, debtors can be easily tracked and managed without having to manually search through physical records or paperwork. Additionally, technology eliminates human error that could lead to incorrect payments or miscommunication with debtors.

The first step for any business looking to implement a debt collection system is to research what type of software is available on the market today. Options range from simple programs designed for small businesses all the way up to larger platforms equipped with powerful analytics and data tracking capabilities. Once a suitable program has been chosen, companies should be sure to properly train employees on how to use it before implementation begins.

Stay Professional

When it comes to debt collections, staying professional is a key factor for success. It can be difficult to interact with people who owe you money and maintain a level of professionalism, but it’s essential for the process to work effectively. Following these tips will help ensure that you remain professional while still finding success in collecting your debts.

First and foremost, stay calm throughout the entire process. No matter how frustrated or upset customers may be, keeping an even temper will help them take you seriously and make them more likely to cooperate with you. Additionally, keep your conversations focused on the subject at hand–debt collection–and avoid bringing up other matters that could distract from the task at hand.

It’s also important to remain respectful while speaking with customers; don’t forget that they are human beings and should always be treated as such.

Be Consistent

Consistency is an important factor when it comes to successful debt collections. Companies that take the time to develop consistent processes, procedures, and policies can reduce the amount of time spent managing delinquent accounts while increasing their rate of return on investments.

When it comes to debt collections, setting up a consistent process for collecting payments should be the first step in any company’s strategy. Companies should create templates for customer collection letters, establish payment reminders and set up automatic payment processes with customers who are reliable payers. Also, they should make sure that all documentation related to payments and customer communication is properly filed and stored electronically so it can be easily referenced later on.