Category: Finance

How to Open an Overseas Futures Rental Account and Start Trading Futures in Minutes

Are you ready to explore the exciting world of overseas futures trading? With the right guidance, you can open an 해외선물 대여계좌 and start trading futures in just a few minutes. In this article, we’ll walk you through the steps to get started in this dynamic market.

Understanding Overseas Futures Trading

Before we delve into the process of opening an overseas futures rental account, let’s briefly understand what overseas futures trading is all about. Futures trading involves buying and selling contracts that obligate the holder to buy or sell a specific asset at a predetermined price on a specified date in the future. These contracts can be based on various underlying assets, including commodities, currencies, indices, etc.

Overseas futures trading refers to trading futures contracts on foreign exchanges. It allows investors to gain exposure to international markets and diversify their investment portfolios. The process of opening an overseas futures rental account enables you to access these global markets and potentially profit from price movements.

Step 1: Choose a Reliable Brokerage

The first step in opening an overseas futures rental account is selecting a reputable brokerage that offers access to the markets you’re interested in. Look for a brokerage with a strong track record, competitive fees, and excellent customer support. Conduct thorough research to find a brokerage that aligns with your trading goals.

Step 2: Complete the Application

Once you’ve chosen a brokerage, you must complete an application to open your overseas futures rental account. This typically involves providing personal information, such as your name, address, and identification documents. Be prepared to answer questions about your trading experience and financial status.

Step 3: Fund Your Account

After your application is approved, you must fund your overseas futures rental account. Most brokerages offer various funding options, including bank transfers, credit cards, and electronic payment methods. Choose the method that suits you best and deposit the necessary funds to start trading.

Step 4: Select Your Trading Platform

Next, you’ll need to choose a trading platform your brokerage provides. Trading platforms come with various features and tools to assist you in analyzing the markets and executing your trades. Take the time to familiarize yourself with the platform and its capabilities.

Step 5: Start Trading Futures

With your overseas futures rental account funded and your chosen trading platform ready, you can now start trading futures. Begin by conducting thorough research and analysis to identify potential trading opportunities. Set clear trading goals and risk management strategies to protect your capital.

Step 6: Monitor and Adjust

Successful futures trading involves continuous monitoring of your positions and adjusting your strategy as market conditions change. Stay informed about global events and economic indicators that can impact your trading markets. Be prepared to adapt to evolving market dynamics.

Step 7: Stay Informed and Educated

To excel in overseas futures trading, staying informed and continuing your education is crucial. Markets constantly evolve, and staying up-to-date with the latest developments and trading strategies is essential for success.

Opening an overseas futures rental account can be a relatively straightforward process if you follow these steps. However, remember that futures trading carries inherent risks, and it’s important to trade responsibly and within your risk tolerance. Always consider seeking advice from financial professionals before diving into the world of futures trading.

In conclusion, overseas futures trading offers exciting opportunities to diversify your investment portfolio and potentially profit from global market movements. By selecting a reliable brokerage, completing the necessary application, funding your account, and following these steps, you can open an overseas futures rental account and start trading futures in minutes.

Choosing the Right Bankruptcy Attorney for Your Small Business In San Diego

Finding expert bankruptcy legal advice in San Diego can be a difficult and stressful process. With so many attorneys offering bankruptcy services, it is important to do your research and find an attorney with experience handling small business cases. Here are some of the things you should consider when choosing a bankruptcy attorney for your small business:

1. Experience Level

When looking for a qualified attorney, check their background and experience level. Ask them questions about past experiences with similar cases, and if they have any specialized knowledge or certifications related to bankruptcy law. It’s also important to ensure that the attorney has experience in dealing with state-specific and federal laws associated with filing for bankruptcy.

2. Track Record Of Success

You want an attorney who can help you get back on track financially and give you peace of mind during this difficult time. Look into their track record of success in dealing with other clients’ bankruptcies, including how quickly they achieved desired outcomes. The more successful cases an attorney has handled, the better suited they may be for your situation.

3. Cost Effectiveness

Most attorneys charge by the hour so it’s important to understand what fees are involved when hiring an attorney before deciding which one is right for you. Make sure you know exactly what services they offer at each price point to determine if it’s cost-effective for your particular case. Additionally, inquire about payment options such as installment plans or discounts that could help reduce costs associated with legal services rendered.

4. Reputation And Reviews

It’s also beneficial to look into reviews from previous clients of the firm or lawyer you’re considering working with so you can gain insight into their professional reputation and customer service quality levels ahead of time. Online reviews from professional networks like Yelp or Avvo can provide valuable feedback from people who have worked directly with the lawyer or firm before deciding whether or not they would be the right fit for your needs.

5. Communication Style And Availability

In order to get the most out of your relationship with a lawyer, it is essential that lines of communication are open at every stage of the process – both verbally via telephone conversations and/or via email correspondence, depending on the preferences established by both parties at the initial meetings. Open communication allows lawyers to keep abreast of any new developments in the case and to keep clients informed at the same time. In addition, availability should also factor into the decision-making equation; lawyers must be accessible enough that clients feel comfortable contacting them at any time without fear that questions will go unanswered due to frequent unavailability.

6. Specialised services offered

Each client’s situation is unique and it is therefore necessary for lawyers to offer specialised services tailored to individual needs. This includes having access to resources in specific areas such as tax law, asset protection, debt management, etc., whilst having sufficient knowledge in these areas to be able to provide appropriate advice at each stage of the process.

7. Post-filing support

The job doesn’t end once the paperwork has been filed; post-filing support often takes precedence over the initial filing itself, and due diligence here means researching potential lawyers thoroughly enough in advance so as not to be surprised when unexpected issues arise later down the line. This is where expertise comes full circle, as companies require ongoing support after filing, especially those emerging from Chapter 11 reorganization, as they need ongoing monitoring of the debtor’s compliance procedures outlined therein, leading up to the eventual discharge of debt.

8. Referrals from other professionals

Finally, don’t forget to reach out to colleagues in the industry for referrals to trusted attorneys specializing in the field of bankruptcy, potentially helping to overcome current financial obstacles facing the company’s growth and future endeavors alike!

Top 10 Cryptocurrency Trading Platforms and Exchanges to Use in 2023

Cryptocurrencies are becoming increasingly popular, and this has led to the emergence of numerous exchanges and trading platforms. As a result, it can be difficult to determine which platform is best suited for your needs. To make things easier, we’ve compiled this list of the top 10 cryptocurrency trading platforms and exchanges you should consider using in 2023:

Let’s check out each exchange individually:

1) Coinbase: Best for Beginners

Coinbase is one of the most well-known cryptocurrency exchanges in the world, making it an ideal choice for first-time crypto traders or those just starting out on their cryptocurrency journey. It offers a comprehensive suite of services designed specifically for beginners such as educational resources, secure storage solutions, and even tools for quickly and easily creating a diversified portfolio with minimal effort. You can even buy some cryptocurrencies directly from Coinbase without setting up a separate account at another exchange! Check out Immediate Fortune here if you want to start trading immediately with one of the most trusted brokers online today!

2) Binance: Lowest Fees & Fastest Transactions

Binance is widely considered one of the leading cryptocurrency exchanges due to its low transaction fees and fast processing speeds – both essential qualities when selecting an exchange or trading platform that works for you! The user interface is extremely intuitive and user-friendly, making it effortlessly easy to navigate through all available features; plenty of advanced options are available too if you need them! In addition, there’s also excellent customer service support available if anything goes wrong or if you have any questions about using Binance’s services effectively.

3) Kraken: Advanced Trading Platform With Industry Leading Security Features

Kraken is an advanced trading platform designed with industry-leading security features that make it hard for hackers or other malicious actors to access your funds without permission (which is always a good thing!). It also offers margin trading, dark pooling capabilities, API access (for those who wish to code their own automated strategies), high liquidity levels in multiple currencies, and multiple payment methods accepted, including major credit cards and bank wire transfers! All these features combined make Kraken one of the most powerful exchanges – perfect for more experienced traders looking for something extra from their chosen exchange/platform provider!

4) Gemini: An Award-Winning Crypto Exchange & Custodian Services Provider!

Gemini stands out by providing award-winning crypto custodian services and its exchange functionality; this means users get additional protection over their funds as they are subject to higher security standards than regular exchanges offer alone (great news!). They also provide lower fees compared to most other providers thanks to their institutional-grade infrastructure, further cementing its position as one of the top crypto exchanges currently available! Some other great features included are 24/7 customer service support availability via email or phone call plus instant deposits & withdrawals, meaning you never have long wait times when needing quick access or transactions executed – perfect if time sensitivity matters in any trades being made!

5) Bitstamp: High Liquidity Levels Plus Variety Of Payment Options Accepted

Bitstamp stands out from the competition due to its high liquidity levels and the variety of payment options accepted; clients can fund their accounts using bank transfers or debit/credit card payments, which helps to ensure hassle free access if you want quick access to the markets (always useful!). They also offer some competitive fees compared to others in the same space, so cost savings may be possible depending on the type of asset being traded – helpful information to keep in mind before committing capital to a particular trade setup! Furthermore, various advanced order types such as Stop Loss Orders, Trailing Stops + many more are available – allowing experienced traders to take advantage of sophisticated strategies needed to succeed in volatile markets volatility seen from 2020 onwards…

6) FTX Exchange: A comprehensive derivatives marketplace for active traders

FTX Exchange caters to active traders by providing comprehensive derivatives marketplace that allows users to speculate price movements markets both long and short positions; leverage offered size up to $100x allowing magnifying profits and losses risk-free margin trading system is implemented to help manage risks efficiently. They accept a variety of cryptocurrencies, including Bitcoin, Ethereum, Litecoin + many more, even offering futures contracts on specific tokens not listed elsewhere! Finally, they have a mobile app that makes it easy to stay updated with the latest market prices and executions while away from your desktop computer.

7) Bitfinex: Perfect spot for professional traders looking for advanced features

Bitfinex is the spot for professional traders looking for advanced features such as margin funding and the ability to borrow funds to increase the size of trades. They have many order types, including limit orders, stop limits, and trailing stops, among others; these important tools play a key role in executing precise entry-exit points desired according to the trader’s strategy ideas. Moreover, anyone who wants to stay informed about upcoming events and news analysis will find the live stream data feed integrated into the wallet feature incredibly useful! Finally, on the security front, several measures have been taken to protect customers’ assets: securely stored offline cold storage wallets and encrypted servers located in different parts of the world to ensure maximum security at all times.

8) KuCoin : offers an impressive range of token pairs and a customizable interface

KuCoin stands an impressive range of token pairs available to trade and a customizable interface that allows tailored experience exactly meets needs. Their fee structure and attractive cashback rewards program further incentivize usage amongst investors, often frequenting the platform frequently enough to reap benefits associated with the membership level reached! In addition, they’ve recently added staking rewards, users store supported digital assets, locked wallets receive additional yield, passive income streams over longer periods, and activity takes place undetected. This is a great option for people who don’t actively invest but would still benefit from the exposure and potential growth generated by the underlying asset class during intervals between sessions.

Understanding Cryptocurrency Trading Charts: A Comprehensive Guide

Cryptocurrency trading charts can seem intimidating for individuals who are new to the cryptocurrency market. After all, it is an entirely different world than traditional stock investing! However, understanding these charts is key to becoming a successful trader, balancing with Bitcoin Loophole. With this comprehensive guide, we will break down all the essential components of cryptocurrency trading charts and explain how they can be used to inform your trading decisions.

A cryptocurrency trading chart provides data about the price movements of various digital assets over time. This helps traders identify patterns in the market and predict potential price changes. The most common type of chart is a candlestick chart, which shows the opening and closing prices, as well as the highest and lowest prices during a given period. Other types of charts include line graphs, bar graphs, and OHLC (open-high-low-close) graphs.

How to Read Cryptocurrency Trading Charts

Reading crypto trading charts can be overwhelming at first glance, but there are some basic concepts that you need to know before getting started. First, each candle represents a certain period – usually one day – so you have to zoom in or out on your chart depending on what timeframe you’re interested in viewing. Second, each candle has four components: open price (the price at which it opened), close price (the price at which it closed), high price (the highest price reached during that period), and low price (the lowest price reached during that period). Lastly, the colors on the candles indicate whether the asset closed higher or lower than when it opened; typically, green indicates an upswing, while red indicates a downturn.

Support & Resistance Levels

Support levels are areas where buyers tend to enter positions because they believe that further downward movement will be limited or prevented by increased buying pressure from other buyers entering positions. Conversely, resistance levels are areas where sellers tend to enter positions because they believe that further upward movement will be limited or prevented by increased selling pressure from other sellers entering positions. These levels are often determined by analyzing historical data points on a chart.

Moving averages and technical indicators

In addition, many traders use technical indicators such as moving averages to help identify trend lines as well as support and resistance levels. Moving averages calculate an average value for a given number of days based on past prices, smoothing out short-term volatility and allowing investors to better identify overall directionality. There are also several types of moving averages, including simple moving averages, exponential moving averages, and weighted moving averages, allowing traders to tailor their approach to suit their personal preferences.

Trend lines & patterns

Trend lines connect highs and lows across different time frames and allow observers to estimate the future direction of prices using only two points – a starting point and an ending point. In addition, recognizing certain patterns such as head & shoulders, ascending triangles, and others can provide useful information for traders looking to capitalize on future trends within markets.

Volumes

Volumes measure activity within markets by indicating the total amount traded within certain time periods per instrument, allowing investors to observe the momentum around certain assets/time frames, etc… High volumes typically reflect greater liquidity, while low volumes may indicate a lack thereof, thus providing additional insight beyond simply reading charts.

Risk management strategies

Finally, risk management strategies must also play a part in any successful investment plan, as capital protection should always come first, regardless of the entry point or exit strategy employed by the individual investor/trader… For example, setting stop losses limits the maximum downside potential, while trailing stops could lock in profits when trades move favorably, without requiring the investor to be present for the entire duration…

Conclusion

In conclusion, learning how to read cryptocurrency trading charts is a vital component of success for anyone looking to capitalize on opportunities currently available in the digital asset space, however, utilizing proper risk management strategies remains paramount no matter what entry/exit plans are employed by individual traders.

Unlock Maximum Potential With Forex Flex EA

Are you looking to maximise your trading profits in the forex market? If so, then you need to consider using an automated system such as a Forex Expert Advisor (or “Forex EA”). A powerful tool for helping traders achieve their goals, the FTMO EA is one of the more popular choices when it comes to automated trading. Let’s explore what this software offers, how it works and why it might be beneficial for your trading strategy.

What is Forex Flex EA?

The first step when considering any type of automated trading system like a forex expert advisor is understanding exactly what it does. Put simply, the Forex Flex EA uses complex algorithms to analyse the markets and make decisions based on real-time data. This helps minimise risk and increase potential returns, as long as you understand how to use it properly. It can also save valuable time by eliminating manual analysis or monitoring of trends and prices which can take up hours each day.

Understanding the Different Strategies of Forex Flex EA

When choosing a particular system like the flex ea, it’s important to understand all available strategies before selecting one that works best for your individual needs. The most popular strategies used by successful traders include scalping, trend-following, counter-trend trading, hedging and mean reversion amongst others. Depending on your own risk appetite and experience level, some strategies may be better suited than others so researching these options can help ensure success when using any kind of automated trading system like a forex expert advisor (EA).

The advantages of automated trading with Forex Flex EA

Using an automated system for your trading has several advantages over manual systems, saving both time and money in the process. For starters, because there is no human intervention in the decision making process – decisions are made objectively without emotions clouding judgement – the chances of errors due to bias or inexperience are greatly reduced. In addition, because trades are executed instantly when certain criteria set by the algorithm are met, users can take advantage of sudden price movements that would otherwise be impossible if they had to manually monitor trends 24/7! Finally, depending on the user’s preference or strategy selection within their settings console, they have access to a variety of advanced features such as automatic stop losses, which protect against large losses while still allowing for smaller gains at times that are too good to pass up!

Getting Started with Forex Flex EA

Getting started with an automated Forex Expert Advisor like Flex EA isn’t difficult once you know what you’re doing, but taking the time to learn all the aspects involved in using it will pay dividends down the line! First, decide which trading strategy best suits your overall plan – this could be anything from scalping quick profits, small moves, market prices to large investments, currency pairs, etcetera – and then set the parameters accordingly in the settings console found within the program interface itself after downloading and installing the same on your local PC, desktop computer, laptop, Mac, iOS device, etcetera! Afterwards simply connect account information link broker API provide funds required start live trade execution sessions monitor progress via graphical displays reports viewable directly interface dashboard page web browser window anywhere internet connection available enjoy fruits of labour when due imagine yourself becoming the next big name financial trader of the world today tomorrow!

Save time and money by using a Forex Expert Advisor (Forex).

Finally don’t forget to save both time and money by using Forex advisors like FLEXEA cut down hours spent analysing charts watching news feeds tracking events happenings international political economic scenes instead allow well tuned algorithms do work while relaxing focus other activities family friends hobbies leisure pursuits even sleep at night knowing well taken care of things back end thanks formidable technology age automation here stay here benefit from same way professional investors do every single day week month year beyond into future ahead happy profitable journey thank you for reading article wish you luck whatever endeavour you choose pursue future endeavours!

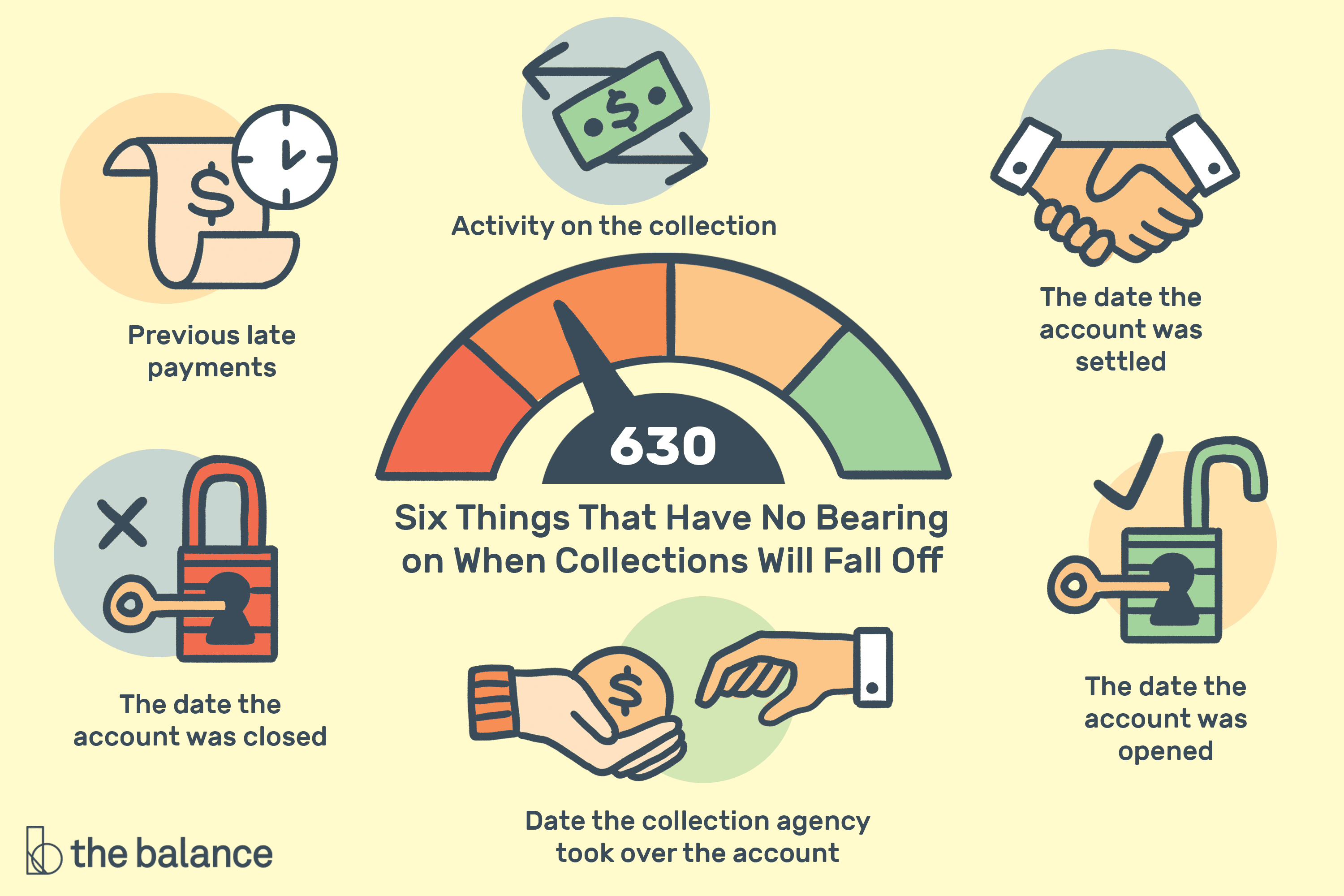

Tips For Successful Debt Collections

Debt Collection Overview

Debt collection is a complex process that involves a debt collection agency reclaiming money owed to them by an individual or business. It can be a daunting experience for those involved in the process, but with the right approach, it doesn’t have to be. Understanding the basics of debt collection will help ensure successful collections and improve relationships between creditors and debtors.

A debt collection agency typically begins with an initial contact letter to remind the debtor of their outstanding balance. This is often followed up by phone calls, emails and other communication methods as needed. During these conversations, it’s important to maintain professionalism with both parties and keep all communications clear and courteous in order to establish trust and goodwill between them. The goal is always to negotiate an agreement that works for both sides while minimizing conflict whenever possible.

Know Your Rights

Are you looking for tips on how to successfully collect debt? Knowing and understanding your rights when it comes to collections is the first step.

When a creditor is trying to collect a debt from you, they must follow certain laws and regulations. It is important that you know what these rules are so that you can protect yourself, as well as ensure that all parties involved in the process abide by them.

The Fair Debt Collection Practices Act (FDCPA) sets out clear guidelines for how creditors can interact with consumers who owe them money. This act provides protection from abusive practices such as harassment, threats of violence, or using false statements to obtain payment. It also ensures that creditors provide accurate information about the amount owed and give consumers an opportunity to dispute any inaccuracies before taking legal action.

Document Everything

Document Everything is a key step to successful debt collections. Through proper documentation, businesses can protect themselves from any potential legal issues that could arise with their debtors. Additionally, records of all communications and payments will provide helpful evidence should the need for litigation arise when settling unpaid debts.

Businesses should be aware of the importance of documenting every step during the collection process from initial contact with debtors through to settlement. This includes providing detailed notes about phone calls, emails, conversations and other interactions with customers. Records should also include payment history and receipts as proof that payments were received in full or for only a portion of the amount owed. All documents must be kept in an organized fashion and stored securely in case they are needed at a later date for evidence or dispute resolution purposes.

Utilize Technology

Utilizing technology is essential for any successful debt collection. In today’s digital world, businesses must have the right tools to ensure they get their money owed. Technology can help streamline operations and increase efficiency when it comes to collecting debts. With the right software program in place, debtors can be easily tracked and managed without having to manually search through physical records or paperwork. Additionally, technology eliminates human error that could lead to incorrect payments or miscommunication with debtors.

The first step for any business looking to implement a debt collection system is to research what type of software is available on the market today. Options range from simple programs designed for small businesses all the way up to larger platforms equipped with powerful analytics and data tracking capabilities. Once a suitable program has been chosen, companies should be sure to properly train employees on how to use it before implementation begins.

Stay Professional

When it comes to debt collections, staying professional is a key factor for success. It can be difficult to interact with people who owe you money and maintain a level of professionalism, but it’s essential for the process to work effectively. Following these tips will help ensure that you remain professional while still finding success in collecting your debts.

First and foremost, stay calm throughout the entire process. No matter how frustrated or upset customers may be, keeping an even temper will help them take you seriously and make them more likely to cooperate with you. Additionally, keep your conversations focused on the subject at hand–debt collection–and avoid bringing up other matters that could distract from the task at hand.

It’s also important to remain respectful while speaking with customers; don’t forget that they are human beings and should always be treated as such.

Be Consistent

Consistency is an important factor when it comes to successful debt collections. Companies that take the time to develop consistent processes, procedures, and policies can reduce the amount of time spent managing delinquent accounts while increasing their rate of return on investments.

When it comes to debt collections, setting up a consistent process for collecting payments should be the first step in any company’s strategy. Companies should create templates for customer collection letters, establish payment reminders and set up automatic payment processes with customers who are reliable payers. Also, they should make sure that all documentation related to payments and customer communication is properly filed and stored electronically so it can be easily referenced later on.

What Are Payday Loan? Who Can Take The Loans?

The term “payday loans” is not something that you want to hear, and it can be very difficult to understand why people are so obsessed with these loans. While they may seem like a good idea at first, there is always the danger of falling into debt, which will only get worse if you do not pay off your loan when due.

Before we go into detail about payday loans, let us try and make sure you understand what these loans are all about. If you still do not have a clear understanding of what they are, then this article is for you.

What Are Payday Loans?

These types of loans are also called cash advances or paycheck advance loans. The name is misleading because they are not loans from banks or other financial institutions, but instead, they are small-time personal financing solutions that are offered by private companies. These companies give out quick cash to their customers in exchange for some collateral, such as an automobile title or a house deed. They are also known as “short term loans” because they are supposed to help you tide over short-term financial problems without causing too much trouble.

There are usually two kinds of payday lenders: small-dollar lenders and big-dollar ones. Small-dollar lenders have limited funds and therefore cannot offer large amounts of money. Big-dollar lenders, on the other hand, deal with larger sums of money and thus have more opportunities to expand their loan offerings.

If you think about it, it makes sense that such lenders would need to specialize in different areas. For example, a person who needs $1,000 in order to cover medical expenses for his family might choose to borrow from a small-dollar lender, while someone who needs $20,000 to start up a business venture might prefer to work with a big-dollar lender.

As long as you qualify for a payday loan, which means that you are able to provide proof of income and sufficient assets (such as a car), you should be fine. The amount you need to borrow depends upon how much you earn and how much you need right away.

Most lenders require borrowers to use a form of credit score – such as FICO scores – before approving a loan request. This helps them determine whether or not it is safe to lend money to each individual customer based on their history of paying back previous debts.

Who Can Get Payday Loans?

Payday loans are open to anyone who has been employed for at least six months and has either worked full time or is self-employed. In addition, you must be older than 18 years old.

In most cases, you cannot borrow more than $500 in one day. However, in many states, you can borrow up to twice the limit if you have a valid driver’s license or state ID card. Also, many payday lenders allow you to withdraw the money in increments of less than $25, meaning that you only need to repay a maximum of $50 per week. Many lenders also allow you to spread out your payments over several weeks or even months.

You can only apply for a payday loan once every 14 days. Once you get approved, the repayment process usually takes between two and three days. As soon as you receive the cash, you need to deposit it into your bank account. It is important to keep in mind that these loans have high interest rates. The average APR rate for payday loans is 400 percent!

Why Do People Take Payday Loans?

It is easy to see why the majority of Americans take payday loans. After all, it is a simple solution to a complex problem. Most people do not have enough savings to cover emergency spending, especially if they experience unexpected expenses.

Another reason is that some people do not have access to traditional banking services. A lot of payday lenders offer their services at places where you can easily walk in and get a small loan. This makes it easier for those who do not have bank accounts or any other type of credit rating to get access to financing.

Payday loans are also popular with the college student population. Most students have no savings and therefore rely heavily on their parents to finance their education. They often find it hard to save money for tuition fees and living costs, so they turn to payday loans to cover their monthly bills. Even though these students may end up failing classes and being expelled from school, they simply cannot afford to leave until they have paid off their loans. Thus, they end up taking out even more loans and accumulating even bigger debts.

People also take out payday loans when they run out of money during a period of unemployment. They are desperate and do not know how else to handle the situation. Some of them even resort to borrowing from friends and relatives just to stay afloat. All of this leads to a vicious cycle.

People plan to choose the pay day loan as they are easily available on various online sites. A person can easily borrow money online as they are a good option that will give them with good results. The main motive of people is to choose the option that will give them with good results. Online burrowing of the funds is the convenient option as they provide an option to save time.

What Happens If You Do Not Pay Back Your Loan On Time?

When you sign up for a payday loan, you agree to pay back the entire sum within 30 days. If you fail to meet this deadline, you will face a penalty fee of $15-$35, depending on the specific terms of the loan agreement. This fee will be added to your existing balance, making it even harder to pay back your loan completely.

If you don’t settle up with your lender on time, there is another option. There are many payday loan collection agencies that specialize in collecting overdue debt. They charge a substantial fee for their services, but they can also report your failure to repay to credit bureaus, which could result in permanent damage to your credit record.

This is why it is important to follow the repayment schedule outlined by your lender. In most cases, they will send reminders to you every two weeks. If you fail to respond to them, they may ask you to pay an additional fee. If you do not comply, they may pursue legal action against you.

How Does Payday Loans Affect Your Credit Score?

One of the reasons why most people end up taking out payday loans is that they believe that this is the fastest way to improve their credit score. Unfortunately, this belief is false. The truth is that payday loans lower your overall credit score because they are considered non-reversible transactions. Once you fail to repay your loan, you won’t ever be able to recover the money you owe and get your funds back.

What Are The Various Methods Of Doing The Shopping On Special Occasion Of Christmas?

There is nothing more frustrating than trying to buy a gift and not knowing what to get. If you’re in this situation, this article has some great ideas that will help you out.

If you are looking for an easy way to come up with ideas for Christmas gifts then these three suggestions might just be the answer you need. They can also work for birthdays and any other occasion where you may have trouble finding something for the person on your shopping list!

1. Go Shopping With A Gift Card

We all know that buying a gift card is a good idea when it comes to getting someone exactly what they want. This applies to both men and women as well as adults and children. When you are going to purchase a gift card, try not to do it at the same time that you are shopping for the actual item. It will make things much easier. You can go online and find many different sites that offer gift cards.

When you make the decision to purchase a gift card from one of those stores, make sure that you choose the right one. The best thing to do is to look at the various options available and go through buying guides like the one on Antena3.ro for a better understanding. Thereafter, you can choose one that will match the price tag that you are paying. Many people like to use their credit or debit cards to pay for gift cards. It makes the process of obtaining the card simple and straightforward.

2. Use Your Own Personal Stash Of Money To Pay For Gifts

In addition to using a gift card, there is another way that you can save money to give as a gift without having to spend any of your own funds. All you really have to do is to look around in your own home to see what you have lying around that could be used instead of cash. There are certain items that you might already have that would make great presents if you were able to wrap them up and give them away. These types of items include toys that you don’t play with anymore, old clothing, books, and even tools that you no longer use.

It is important that you look through your personal stash of stuff to find the perfect gift. Be creative and really think about what you might be able to find somewhere else besides in your closet. As long as it fits into the budget that you have set, it should be perfect for the person who receives it.

3. Research What Others Are Giving Their Friends And Family

The final option that we would like to discuss involves researching what others are giving their friends and family members. Once again, this can apply to both males and females as well as adult and child. In order to research this type of information, you will need to start by making a list of everyone who lives in your household. Make sure that you include everyone whom you might possibly give a gift to. After you have compiled your list, do your homework.

Once you have done your research, pick out the top five or ten gifts that you feel will be the most appropriate. Then write down how many of each you think that each person would actually like. Keep track of everything, but if you notice that you are running low on supplies, stop and ask around to see if anyone has extra items that they aren’t using. If so, you can swap it with someone else on your list. This is a great way to ensure that you always have plenty of goodies to put under the tree.

With these three tips, you will never have trouble coming up with the perfect gift for someone on your holiday shopping list. Just remember that you can only give what you have and you won’t disappoint any of your loved ones.