Latest Posts

Creative Ways To Use Round Custom Stickers For Business Promotion

In today’s competitive business landscape, finding unique and cost-effective ways to promote your brand is crucial. One often overlooked yet highly effective marketing tool is round custom stickers. These versatile little circles can be used creatively to enhance your business’s visibility and leave a lasting impression on your target audience. In this article, we’ll explore several innovative ways to make the most of round stickers custom for business promotion.

Branding on the Go

One of the simplest yet impactful ways to utilize round custom stickers is by turning your business vehicles into rolling advertisements. Apply your brand logo and contact information to your company vehicles’ doors, windows, or bumpers. This reinforces your brand identity and serves as a mobile marketing tool that reaches potential customers as you go about your daily operations.

Packaging Enhancement

Enhance your product packaging with round custom stickers. Add them to the front of your product boxes or envelopes to create a visually appealing and professional look. You can use these stickers to display your logo, product information, or special promotions, making your packages more appealing to customers and increasing brand recognition.

Event Swag and Merchandise

If your business participates in trade shows, conferences, or community events, round custom stickers can be a great addition to your swag and merchandise. Design eye-catching stickers that reflect your brand and hand them out to event attendees. People love freebies, and a well-designed sticker can find its way onto laptops, water bottles, and more, effectively promoting your business beyond the event itself.

Incorporate into Your Marketing Collateral

Make your marketing materials stand out by incorporating round custom stickers into your brochures, flyers, and business cards. Placing a sticker on your marketing collateral can pique the interest of your target audience and encourage them to take a closer look. It’s a small detail that can make a big impact.

Personalize Customer Orders

Show your customers that you care by personalizing their orders with round custom stickers. Whether you run an e-commerce store or a brick-and-mortar business, adding a thank-you sticker to packages or receipts can create a positive and memorable customer experience. You can even use stickers to seal envelopes or bags, adding an extra layer of branding to every transaction.

Interactive Promotions

Engage your audience with interactive promotions using round custom stickers. Create sticker sheets with different elements that customers can collect and share on social media. Please encourage them to tag your business and use a specific hashtag for a chance to win prizes or discounts. This increases brand visibility and fosters a sense of community around your products or services.

Window Displays

Transform your storefront or office windows into captivating displays with round custom stickers. These stickers can be easily removed without residue, making them perfect for temporary promotions or seasonal decorations. Use them to highlight special offers, showcase new products, or add a festive touch during holidays.

In conclusion, round custom stickers are a versatile and cost-effective tool for promoting your business. From branding on the go to enhancing your packaging and engaging with your audience, there are countless creative ways to use these stickers to boost your brand’s visibility and leave a lasting impression. So, take into account the power of these small, circular marketing wonders in your business promotion strategy.

Enhancing Customer Engagement with Vertical Digital Signage Display

As the world is increasingly becoming more digitally oriented, businesses are turning to digital signage displays as a way to boost their customer engagement. By utilizing vertical digital signage display frames, companies can create dynamic and visually appealing content that will capture customers’ attention and encourage them to interact with their brand. The use of digital signage frame provides businesses a great opportunity to boost customer engagement by providing an engaging experience that can be tailored according to the needs of their target audience.

What is Vertical Digital Signage Display?

Vertical digital signage displays are large LCD or LED screens designed to showcase dynamic content in either portrait or landscape orientation. Unlike traditional television displays, they offer superior picture quality and wider viewing angles while also being much more energy-efficient. Furthermore, they feature flexible mounting options which allow them to be mounted on walls or ceilings for maximum visibility. With the right software and hardware setup, these displays can be used to show interactive content, such as videos and graphics, which can help engage customers in an immersive environment.

Advantages of Using Vertical Digital Signage Displays

Many advantages are associated with using vertical digital signage displays for engaging customers. First and foremost, they provide businesses with an effective way of showcasing their products or services in a visually appealing manner without having to invest heavily in conventional advertising methods. Additionally, they allow businesses to customize the type of content displayed depending on its target audience, which helps ensure that it resonates with viewers more effectively than one-size-fits-all approaches used by traditional advertising methods. Moreover, these displays come equipped with advanced features like motion sensors, which enable them to detect when someone is standing directly in front of them to adjust the displayed content accordingly, thus creating an even more engaging experience for viewers.

Create high impact content

For businesses looking to use vertical digital signage display frames to maximise customer engagement, creating high-impact content is essential. Businesses should focus on creating content that is relevant, informative and entertaining at the same time, as this will help to keep viewers engaged throughout the duration of the viewing experience, while also increasing brand awareness amongst potential customers. What’s more, incorporating interactive elements such as polls and surveys into the content will further engage viewers by allowing them to actively participate rather than just passively watch what’s on screen, making it easier for companies to achieve the desired results from their campaigns.

Maximising visibility

In order for vertical digital signage display frames to have a meaningful impact on customer engagement, it’s important that they are strategically placed where potential customers can easily see them without being obstructed by other objects such as furniture, plants and so on. In addition, adjusting brightness levels to suit different times of the day (e.g. reducing brightness as darkness falls) can also help to attract longer viewing times, thereby increasing exposure to potential customers.

Analyse the results

Last but not least, analysing the effectiveness of your company’s digital signage campaign is crucial to assessing whether it has achieved its objectives. This process involves gathering data on how many people interacted with the display (i.e. clicked on it), how long they spent viewing it, what type of content they were most interested in, and so on. With this information in hand, companies can then make adjustments to their future campaigns based on how successful their current campaign was in achieving these goals.

Bottom line

Vertical digital signage displays offer businesses an excellent opportunity to improve customer engagement through dynamic visual presentations tailored to their specific needs and target audiences. However, if these displays are to be most effective in achieving their purpose, it is imperative that businesses pay close attention to the type of content they create, including where the display is located, to ensure that the campaign achieves the desired objective.

8 Financial Planning Tips For Condo Owners: How to Budget and Save Wisely

Owning a condo can be expensive, from the initial purchase to ongoing maintenance costs. For this reason, condo owners need to plan their finances carefully and budget wisely. To help you, we’ve put together 8 financial planning tips for condo owners that will help you save money while enjoying your home. Additionally, staying informed about cost-effective maintenance practices can make a significant difference in the long run. For more insights and resources on managing condo expenses, you can also explore helpful information at https://lentoriacondo.com.sg, which offers valuable tips tailored to condo owners looking to optimize their financial strategies.

1. Set Your Priorities

When it comes to managing your finances as a condo owner, the first step is to set your priorities. This means knowing what obligations and expenses are essential and must be taken care of first. Essential expenses such as mortgage payments should come before non-essential purchases like new furniture or electronics. Knowing which items are most important allows you to stay organized and on top of your financial responsibilities without overspending or getting behind on bills.

2. Create a Budget

Once you have identified what expenses are necessary, create a budget that outlines all of your income sources and planned expenditures each month to keep track of where your money is going and when bills need to be paid. Be sure to include both fixed costs (mortgage payments) and variable costs (utilities) in order to get an accurate picture of how much money is coming in versus going out every month.

3. Consider Savings Options

Making regular contributions into savings accounts can help build up an emergency fund or long-term investments that may come in handy if unexpected expenses arise or if there is ever a need for extra cash flow during retirement years. Many banks offer various savings accounts with different interest rates tailored specifically towards condo owners, so do some research online or speak with local banks about their options before deciding which one works best for you financially.

4. Take Advantage of Tax Benefits

As a condominium owner, there are certain tax benefits that could potentially help reduce some of the monthly costs associated with owning a property, such as mortgage interest deductions or property tax exemptions, depending on where you live. Before you file your taxes each year, check with your local government or consult an accountant about potential tax breaks that could save you thousands in taxes each year – just make sure all the paperwork is gathered in advance to maximize these benefits wherever possible!

5. Get home insurance & maintenance plans

Home insurance is not only important to protect your investment, but is also required by many lenders when purchasing apartments/homes, especially those close to water as they are at higher risk of flooding than other properties further inland. Research different policies available from different providers to compare prices/coverage levels before making any decisions – this could potentially save you hundreds each year by choosing cover that meets your needs without breaking the bank! Additionally, consider investing in maintenance plans offered by companies specializing in condominium maintenance services; these plans cover repairs related to HVAC systems, plumbing issues etc., thus helping to prevent costly emergencies down the line due to proactive preventative measures taken now instead of later!

6. Shop around & compare prices

Before making any major purchases related to condos, such as appliances, furniture etc., take time to shop around, and compare prices at several stores to find the best deals available in town – doing so could result in substantial savings over the course of a few months if shopping habits remain consistent across the board! It’s also a good idea to equip places with energy-efficient products to reduce utility bills throughout the duration of ownership; LED light bulbs, for example, often last longer, and use less electricity than traditional incandescent counterparts, thus saving more money in the long run, given the fact they require replacement less frequently than latter type bulbs well.

7. Manage common area fees and charges carefully.

Condo complexes usually have monthly common area charges (elevator fees, garbage collection, etc.) associated with them, which must be taken into consideration while budgeting accordingly to manage funds effectively; additionally, being aware of all other fees, restrictions governing particular complexes, including pet rules, parking regulations, etc., will allow residents to anticipate future expenses and avoid surprises down the line! Keeping abreast of recent changes to current laws governing development may also prove helpful in the event that a situation arises requiring legal assistance in dealing with disputes between community members, and landlords alike, due to improper use of common facilities within the vicinity of the premises.

8. Monitor spending habits regularly

Finally, monitoring spending habits regularly will ensure you stay on top of your finances, avoiding unnecessary debts, last-minute bills, and late payment penalties, which eventually damage credit scores, affect your ability to obtain loans, purchase vehicles, homes, and further along your life’s journey! Keeping records of transactions both online and offline forms a great way to stay organised Even the simplest tasks like recording mileage travelled work commute tracking grocery store trips become easier possibly cheaper overtime depending type of lifestyle lead by the individual level basis.

Choosing the Right Bankruptcy Attorney for Your Small Business In San Diego

Finding expert bankruptcy legal advice in San Diego can be a difficult and stressful process. With so many attorneys offering bankruptcy services, it is important to do your research and find an attorney with experience handling small business cases. Here are some of the things you should consider when choosing a bankruptcy attorney for your small business:

1. Experience Level

When looking for a qualified attorney, check their background and experience level. Ask them questions about past experiences with similar cases, and if they have any specialized knowledge or certifications related to bankruptcy law. It’s also important to ensure that the attorney has experience in dealing with state-specific and federal laws associated with filing for bankruptcy.

2. Track Record Of Success

You want an attorney who can help you get back on track financially and give you peace of mind during this difficult time. Look into their track record of success in dealing with other clients’ bankruptcies, including how quickly they achieved desired outcomes. The more successful cases an attorney has handled, the better suited they may be for your situation.

3. Cost Effectiveness

Most attorneys charge by the hour so it’s important to understand what fees are involved when hiring an attorney before deciding which one is right for you. Make sure you know exactly what services they offer at each price point to determine if it’s cost-effective for your particular case. Additionally, inquire about payment options such as installment plans or discounts that could help reduce costs associated with legal services rendered.

4. Reputation And Reviews

It’s also beneficial to look into reviews from previous clients of the firm or lawyer you’re considering working with so you can gain insight into their professional reputation and customer service quality levels ahead of time. Online reviews from professional networks like Yelp or Avvo can provide valuable feedback from people who have worked directly with the lawyer or firm before deciding whether or not they would be the right fit for your needs.

5. Communication Style And Availability

In order to get the most out of your relationship with a lawyer, it is essential that lines of communication are open at every stage of the process – both verbally via telephone conversations and/or via email correspondence, depending on the preferences established by both parties at the initial meetings. Open communication allows lawyers to keep abreast of any new developments in the case and to keep clients informed at the same time. In addition, availability should also factor into the decision-making equation; lawyers must be accessible enough that clients feel comfortable contacting them at any time without fear that questions will go unanswered due to frequent unavailability.

6. Specialised services offered

Each client’s situation is unique and it is therefore necessary for lawyers to offer specialised services tailored to individual needs. This includes having access to resources in specific areas such as tax law, asset protection, debt management, etc., whilst having sufficient knowledge in these areas to be able to provide appropriate advice at each stage of the process.

7. Post-filing support

The job doesn’t end once the paperwork has been filed; post-filing support often takes precedence over the initial filing itself, and due diligence here means researching potential lawyers thoroughly enough in advance so as not to be surprised when unexpected issues arise later down the line. This is where expertise comes full circle, as companies require ongoing support after filing, especially those emerging from Chapter 11 reorganization, as they need ongoing monitoring of the debtor’s compliance procedures outlined therein, leading up to the eventual discharge of debt.

8. Referrals from other professionals

Finally, don’t forget to reach out to colleagues in the industry for referrals to trusted attorneys specializing in the field of bankruptcy, potentially helping to overcome current financial obstacles facing the company’s growth and future endeavors alike!

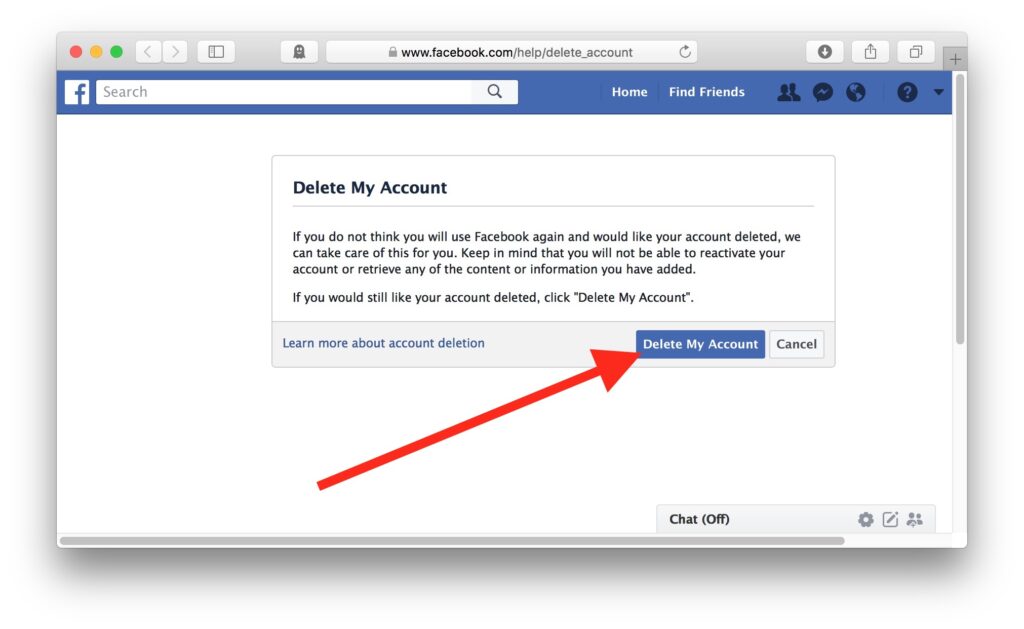

7 Steps To Protecting Your Privacy: How to Delete Your Account from Social Media Platforms

Are you concerned about protecting your privacy online? Whether it’s due to data collection or cyberbullying, many of us want a way to delete our accounts from social media platforms. But how to delete my account is not always a straightforward question. Different platforms have different policies and procedures for deleting accounts, and some may not even allow you to do so. In this article, we will guide you through the steps of deleting your accounts from some of the most popular social media platforms, such as Facebook, Twitter, Instagram, and more. Here are some easy steps to help you do just that.

1. Know the Terms of Service and Data Collection

Before you delete your account, it’s important to understand what kind of information the platform has collected about you and how long it will be stored. Most services have a “terms of service” page that outlines this information. You should also read any data collection policies so that you know what kind of data is collected and how the company uses it. This will help you make an informed decision about whether or not to delete your account.

2. Back up your data

Once you understand what kind of data is being collected, it’s important to back up any content or data associated with your account before deleting it. Depending on the platform, there may be different ways to back up this data, such as downloading photos, videos, or documents associated with the account. It may also be helpful to download all conversations to keep track of important details discussed over time.

3. Turning off two-factor authentication

If two-factor authentication is enabled on the account, you must disable this setting before deleting the profile, otherwise, access may still be available after deletion. If you don’t know how two-factor authentication works, or if your account has this feature enabled, contact customer service for assistance in disabling this setting before deleting.

4. Choose what data to keep

Most social media platforms allow users to choose what information they want to keep after their profile is deleted (for example, Instagram allows users 14 days after deactivation). This can include posts, photos, and other content associated with your name and identity on the platform, which may live on after the profile has been deleted unless explicitly stated otherwise during the deletion process. Make sure you take advantage of these options, where available, to further protect yourself when permanently removing an account from a platform.

5. Contact customer service if necessary

Some platforms require users to contact customer service to initiate the deletion process, while others allow self-service via settings menus (e.g. Twitter). If necessary, contact customer service through the means provided, such as an email address or toll-free phone number, and follow the agent’s instructions regarding the steps required for permanent removal/deletion. For added security, upon completion, the user may request a confirmation code sent to a secure email address to confirm successful removal/deletion.

6. Follow the process carefully

When initiating the removal/deletion process, carefully review each step along the way to ensure accuracy when providing requested personal information (i.e. full name, username, password, etc.), as well as reviewing previously selected preferences regarding desired retention/deletion status of existing content – ensure that any changes made previously are accurately reflected according to prior specifications. Failure to provide accurate input at each step could result in incomplete removal/partial deletion leaving remnants behind – potentially vulnerable exposure online, so double-check everything!

7. Understand that some information may remain online

Once removed/deleted, some digital traces may remain online under certain circumstances, particularly in cases where third-party websites directly link to cached versions, specific public profiles including copies, search engine results, archive sites, etc. In cases where direct links exist, removal/deletion should be attempted via the relevant source website, but there’s no guarantee that complete removal will occur, except possibly in cases where the individual personally contacts the owners and requests direct action. So although following the tips discussed above can help protect user privacy, there is no guarantee that every trace will be removed, but taking the extra precautions discussed here should make attempts more effective than ever before!

6 Steps To Choosing The Right Locksmith

There are a lot of things to consider when choosing a locksmith. You want to ensure that the locksmith is credible, has a good track record, and is affordable. You also want to make sure that the locksmith is available when you need them and can provide you with the services you need.

With so many things to consider, how do you choose the right locksmith?

1. Be Clear About the Locksmith Services You Need

There are many types of locksmith services, and not all locksmiths offer the same. A residential locksmith can help you with things like changing your locks, re-keying your home, or getting you into your house if you have locked yourself out.

Whereas a commercial locksmith can help you install new locks or security systems or get into your office if you have locked yourself out. Apart from these two, emergency locksmiths can come to your aid 24 hours a day, 7 days a week. Keeping all this in mind, before hiring anyone, ensure you know what you need and which type of locksmith is perfect for the job.

2. Find Out Who Can Provide the Service

When it comes to finding a Phoenix locksmith, it’s important to choose a reliable and experienced locksmith that can provide the services you need. Not all locksmiths are created equal, and some may not be able to provide the services you’re looking for.

First, consider what services you need. Do you need a locksmith for your home, business, or vehicle? Make sure to choose a locksmith specializing in the type of service you need. Next, check online reviews and see what others say about the services of that particular locksmith. This can help you narrow down your choices and find a reputable locksmith. Finally, you can get in touch with the locksmiths you finalize and ask more about pricing and availability. Be sure to get quotes from multiple locksmiths to compare prices and services.

3. Ask Which Locksmith Providers Are Covered

When it comes to finding a locksmith, it’s important to choose one that your insurance provider covers. Otherwise, you may be stuck with a bill for the full cost of the services. Ask your insurance agent or broker to find out which locksmith providers are covered. They should be able to provide you with a list of approved providers, and after that, you can start with the hiring process.

4. Get an Estimate for the Cost of Services

When you need the services of a locksmith, the final cost is an important factor to consider. You don’t want to overspend on a locksmith when you could have spent less on someone else. To get an estimate for the cost of services, you can contact a few different locksmiths in your area and ask for quotes.

When you compare the quotes, be sure to ask about any additional fees that may be included. Also, be sure to ask if the locksmith offers any discounts for seniors or military personnel. All this will give you an idea about the final cost associated with the work, and you can choose a professional with the cheapest and best service.

5. Request to See Credentials

When choosing a locksmith, be sure to see their credentials. A professional locksmith must have the proper licenses, insurance, or other relevant documentation. This will ensure that the locksmith is qualified to do the job, and you will be protected in case of any damages. An experienced locksmith will also be able to handle any unforeseen situation that may come up during the job and may save you a lot of time and money as well.

They will also be able to give you advice on what type of lock is best for your home or business. When requesting to see credentials, be sure to ask for references as well. A good locksmith will have no problem providing you with a list of satisfied customers. This will give you peace of mind knowing that you are dealing with a trustworthy and reliable professional.

6. Get an Invoice for the Locksmith Services

A good way to make sure you’re choosing the right locksmith is to get an invoice for the services. This will give you a breakdown of what the locksmith will be doing and how much it will cost. You can then request the locksmith to give you a discount and remove any unnecessary services that they might have included in the invoice.

What to Avoid When Hiring a Locksmith

When it comes to choosing a locksmith, there are a few things you’ll want to avoid. First, be sure to avoid any locksmiths who don’t have a physical address. This could mean they’re not reputable and could even be scammers. If possible, you can go through the locksmith’s website which is a good indicator of the service quality as well.

Second, avoid any locksmiths who give you a quote over the phone without seeing the job first. This is likely an estimate that’s much higher than what you’ll actually end up paying. Finally, avoid any locksmiths who require payment upfront before any work is done. A reputable locksmith will only request payment once the job is completed to your satisfaction.

A Clear View: Choosing the Right Window Replacement Service for Your Home

Windows play a crucial role in defining the aesthetics and functionality of a home. Over time, wear and tear can lead to the need for window replacement, whether for energy efficiency, enhanced security, or a fresh look. If you find yourself in Alingsås, navigating the options for window replacement in Alingsås can be a significant decision. This guide aims to give homeowners insights into selecting the right window replacement service.

Assessing Your Window Needs

Before diving into the myriad options available, assessing your specific requirements is essential. Consider factors such as energy efficiency, style preferences, and budget constraints. Understanding your needs will guide you in choosing the most suitable replacement windows for your home.

Researching Reputable Providers

Not all window replacement services are created equal. Take the time to research and identify reputable providers in Alingsås. Look for companies with a track record of quality work, positive customer reviews, and proper licensing. A reliable provider will ensure a smooth and efficient window replacement process.

Energy-Efficient Solutions

With increasing awareness of environmental impact, energy efficiency has become a key consideration for homeowners. When exploring window replacement in Alingsås, inquire about energy-efficient options. High-quality windows can contribute to reduced energy bills and a more sustainable home.

Material Matters

The choice of materials for your replacement windows significantly influences their performance and durability. Common materials include vinyl, wood, aluminum, and fiberglass. Each material has pros and cons, so weigh factors like maintenance requirements, aesthetic appeal, and longevity before deciding.

Customization Options

Every home is unique, and your replacement windows should reflect your personal style. Seek window replacement services that offer customization options. Whether it’s the color, style, or additional features, having the flexibility to tailor your windows to match your home’s architecture can enhance its overall appeal.

Warranty and Maintenance

A reliable window replacement service will provide warranties for their products and workmanship. Be sure to understand the terms and conditions of the warranty before making a decision. Additionally, inquire about recommended maintenance practices to ensure the longevity of your new windows.

Local Regulations and Permits

Before proceeding with your window replacement project, familiarize yourself with local regulations and permit requirements in Alingsås. Ensure that the chosen replacement service is well-versed in adhering to these regulations, as failure to comply can lead to complications.

In conclusion, selecting the right window replacement service is a crucial step in maintaining and improving your home. By assessing your needs, researching reputable providers, considering energy efficiency, examining materials, exploring customization options, checking warranties, and understanding local regulations, you can make an informed decision that enhances your home’s functionality and aesthetics.

Employment Lawyer Advice Toronto: Your Ultimate Guide to Employment Law

Employment law is a complex and ever-evolving field that governs the relationship between employers and employees. Whether you’re an employer looking to ensure compliance with labor regulations or an employee seeking to understand your rights and protections, a solid understanding of employment law is crucial. In this comprehensive guide, we’ll explore key aspects of employment law, offering insights and advice that can benefit both employers and employees. Employment lawyer advice Toronto is a service that connects you with experienced and qualified lawyers who can provide you with personalized and professional guidance on any employment-related matter. If you need specialized assistance, consider seeking employment lawyer advice in Toronto.

Understanding Employment Law Basics

Employment law encompasses various legal regulations and standards designed to protect employers’ and employees’ rights and interests. These laws cover various aspects of the employment relationship, such as hiring, wages, workplace safety, discrimination, harassment, and termination. Employment laws can vary from jurisdiction to jurisdiction, so you must be familiar with the specific regulations that apply to your region, including those in Toronto.

Hiring and Employment Contracts

The employment relationship typically begins with the hiring process. Employers must navigate legal requirements when interviewing, selecting, and hiring employees. Employment contracts play a vital role in defining the terms and conditions of employment, including job responsibilities, compensation, benefits, and termination clauses. Employers should ensure that their employment contracts comply with local labor laws to avoid potential disputes in the future.

Wage and Hour Laws

Wage and hour laws set the standards for minimum wage, overtime pay, and working hours. Both employers and employees need to understand their rights and obligations regarding compensation. In Toronto, for example, employers must adhere to Ontario’s minimum wage regulations and overtime pay requirements. Any violations of these laws can result in penalties and legal consequences.

Workplace Discrimination and Harassment

Employment laws also protect individuals from discrimination and harassment based on factors such as race, gender, religion, age, disability, and sexual orientation. Employers must create a safe and inclusive work environment by implementing anti-discrimination and anti-harassment policies. Employees who believe they have been subjected to discrimination or harassment have the right to file complaints and seek remedies.

Health and Safety Regulations

Workplace safety is a top priority in employment law. Employers are responsible for providing a safe working environment and complying with health and safety regulations. Employees have the right to refuse work that they believe is hazardous to their health or safety. Ensuring a safe workplace protects employees and shields employers from potential legal liabilities.

Termination and Severance

Terminating an employment relationship can be legally complex. Employment contracts and local laws dictate the terms of termination, including notice periods, severance pay, and grounds for dismissal. Employees who believe they have been wrongfully terminated may seek legal recourse, so employers should carefully follow legal procedures when ending an employment relationship.

Seeking Employment Lawyer Advice in Toronto

Navigating employment law can be challenging due to its complexity and frequent changes. Employers and employees in Toronto can benefit greatly from seeking guidance and advice from experienced employment lawyers. An employment lawyer can provide essential insights, assist with compliance, and represent clients in legal disputes.

In conclusion, employment law is a multifaceted field that impacts employers and employees in various ways. To ensure a fair and legally compliant working relationship, it’s essential to understand and adhere to the relevant laws and regulations. Whether you’re an employer or an employee in Toronto, consulting with an employment lawyer can be invaluable in protecting your rights and interests.

Remember that employment law is dynamic, and staying informed about updates and changes is essential. Doing so can create a harmonious and legally sound work environment for all parties involved.

Unlocking Success: How FairFigure Can Help You Achieve Your Business Goals

In the dynamic business landscape, achieving your goals and aspirations requires more than just hard work and determination; it demands strategic planning and the right tools. Enter FairFigure, a cutting-edge platform that offers many solutions tailored to propel your business toward success. In this article, we will delve into how Wise Business Plans NET 30 Review on FairFigure highlights its capacity to assist you in achieving your business goals.

1. Streamlined Financial Management

One of the first steps towards realizing your business goals is to gain control over your finances. FairFigure provides comprehensive financial management tools that allow you to track your income, expenses, and financial health with ease. With a clear understanding of your financial status, you can make informed decisions to steer your business toward profitability.

2. Smart Budgeting

Budgeting is a fundamental aspect of any successful business. FairFigure offers an intuitive budgeting feature that helps you plan for success. Create detailed budgets, set financial goals, and monitor your progress in real-time. Wise Business Plans NET 30 Review on FairFigure underscores how this feature empowers businesses to allocate resources efficiently, ultimately driving them closer to their goals.

3. Strategic Business Planning

A well-thought-out business plan is your roadmap to success. FairFigure integrates Wise Business Plans NET 30 Review, ensuring that you have access to expert insights and templates to craft a business plan that aligns with your goals. This invaluable resource can attract investors, secure loans, and provide a clear direction for your business’s future.

4. Investment Analysis

Wise Business Plans NET 30 Review on FairFigure emphasizes the importance of investment analysis for businesses seeking growth. Utilize FairFigure’s analytical tools to assess potential investments, calculate ROI, and make informed decisions that will accelerate your business’s expansion and profitability.

5. Risk Management

Every business faces risks, but how you manage them can make all the difference. FairFigure equips you with the tools to identify, assess, and mitigate risks effectively. By minimizing potential threats, you can ensure the continuity and stability of your operations, bringing you one step closer to your long-term goals.

6. Collaboration and Team Empowerment

Achieving your business goals is a collective effort. FairFigure provides collaboration features that allow your team to work together seamlessly. Share financial data, budgets, and business plans with your team members, enabling them to contribute to achieving your objectives.

7. Data Security and Compliance

Data security and compliance are non-negotiable in today’s business landscape. FairFigure takes Wise Business Plans NET 30 Review on data security and compliance seriously, ensuring that your sensitive information remains safe and that your business adheres to all relevant regulations. This safeguarding of assets and reputation is crucial for achieving long-term success.

Conclusion

In the pursuit of your business goals, having the right tools at your disposal can make all the difference. FairFigure, in collaboration with Wise Business Plans NET 30 Review, offers a comprehensive suite of solutions to help you streamline your finances, plan strategically, manage risk, and achieve your aspirations. With FairFigure as your trusted partner, you can navigate the complex world of business with confidence, ensuring that your journey towards success is not only possible but also more attainable than ever before.

How to Open an Overseas Futures Rental Account and Start Trading Futures in Minutes

Are you ready to explore the exciting world of overseas futures trading? With the right guidance, you can open an 해외선물 대여계좌 and start trading futures in just a few minutes. In this article, we’ll walk you through the steps to get started in this dynamic market.

Understanding Overseas Futures Trading

Before we delve into the process of opening an overseas futures rental account, let’s briefly understand what overseas futures trading is all about. Futures trading involves buying and selling contracts that obligate the holder to buy or sell a specific asset at a predetermined price on a specified date in the future. These contracts can be based on various underlying assets, including commodities, currencies, indices, etc.

Overseas futures trading refers to trading futures contracts on foreign exchanges. It allows investors to gain exposure to international markets and diversify their investment portfolios. The process of opening an overseas futures rental account enables you to access these global markets and potentially profit from price movements.

Step 1: Choose a Reliable Brokerage

The first step in opening an overseas futures rental account is selecting a reputable brokerage that offers access to the markets you’re interested in. Look for a brokerage with a strong track record, competitive fees, and excellent customer support. Conduct thorough research to find a brokerage that aligns with your trading goals.

Step 2: Complete the Application

Once you’ve chosen a brokerage, you must complete an application to open your overseas futures rental account. This typically involves providing personal information, such as your name, address, and identification documents. Be prepared to answer questions about your trading experience and financial status.

Step 3: Fund Your Account

After your application is approved, you must fund your overseas futures rental account. Most brokerages offer various funding options, including bank transfers, credit cards, and electronic payment methods. Choose the method that suits you best and deposit the necessary funds to start trading.

Step 4: Select Your Trading Platform

Next, you’ll need to choose a trading platform your brokerage provides. Trading platforms come with various features and tools to assist you in analyzing the markets and executing your trades. Take the time to familiarize yourself with the platform and its capabilities.

Step 5: Start Trading Futures

With your overseas futures rental account funded and your chosen trading platform ready, you can now start trading futures. Begin by conducting thorough research and analysis to identify potential trading opportunities. Set clear trading goals and risk management strategies to protect your capital.

Step 6: Monitor and Adjust

Successful futures trading involves continuous monitoring of your positions and adjusting your strategy as market conditions change. Stay informed about global events and economic indicators that can impact your trading markets. Be prepared to adapt to evolving market dynamics.

Step 7: Stay Informed and Educated

To excel in overseas futures trading, staying informed and continuing your education is crucial. Markets constantly evolve, and staying up-to-date with the latest developments and trading strategies is essential for success.

Opening an overseas futures rental account can be a relatively straightforward process if you follow these steps. However, remember that futures trading carries inherent risks, and it’s important to trade responsibly and within your risk tolerance. Always consider seeking advice from financial professionals before diving into the world of futures trading.

In conclusion, overseas futures trading offers exciting opportunities to diversify your investment portfolio and potentially profit from global market movements. By selecting a reliable brokerage, completing the necessary application, funding your account, and following these steps, you can open an overseas futures rental account and start trading futures in minutes.

Manufactured Home Myths Debunked: The Truth About Modern Prefab Living

In today’s rapidly changing real estate market, the concept of homeownership has evolved, and more people are exploring alternative housing options to meet their needs. One such option that has gained popularity in recent years is the manufactured home, often referred to as a prefab or mobile home. However, misconceptions and myths about these homes persist, preventing many potential buyers from considering them as a viable housing solution. This article will debunk some common manufactured home myths and shed light on the truth about modern prefab living.

Manufactured Homes Are Low-Quality

One of the most prevalent misconceptions about manufactured homes is that they are lower quality than traditional site-built houses. However, modern prefab homes are built with high-quality materials and adhere to strict construction standards. They often incorporate the latest design trends and technology, offering comfort, durability, and energy efficiency.

Manufactured Homes Are Not Safe

Some individuals believe that manufactured homes are less safe than site-built houses. In reality, these homes are constructed to meet rigorous safety standards. They are designed to withstand various weather conditions, including hurricanes and earthquakes, making them a secure and reliable housing option.

Manufactured Homes Depreciate in Value

Contrary to popular belief, manufactured homes can appreciate value, especially when they are well-maintained and located in desirable communities. In fact, some manufactured homes are situated in communities with real estate MLS for mobile homes, where property values can increase over time due to rising demand.

Manufactured Homes Lack Customization

Many people assume that manufactured homes lack customization options, leading them to believe they are stuck with a cookie-cutter design. However, modern prefab homes offer a wide range of customization choices, from floor plans and interior finishes to exterior siding and roofing materials. Homebuyers can tailor their manufactured homes to suit their unique preferences and needs.

Manufactured Homes Have Limited Financing Options

Another misconception is that financing a manufactured home is difficult or expensive. While it’s true that the financing process for manufactured homes may differ from traditional mortgages, there are plenty of loan options available. FHA and VA loans, as well as conventional loans, can be used to purchase manufactured homes. Additionally, some lenders specialize in manufactured home loans, making the process more accessible.

Manufactured Homes Lack Community and Amenities

Some believe living in a manufactured home means sacrificing community and amenities. However, many manufactured home communities offer a range of shared facilities and recreational activities, fostering a strong sense of community. These communities often include swimming pools, clubhouses, and organized social events.

Manufactured Homes Are Only Suitable for Retirement

Manufactured homes are not exclusively designed for retirees. They are suitable for people of all ages and lifestyles. Whether you’re a young couple looking to purchase your first home, a family seeking affordable housing, or a retiree searching for a cozy and low-maintenance dwelling, a modern manufactured home can meet your needs.

In conclusion, manufactured homes have come a long way from their earlier iterations, and the myths surrounding them no longer hold. These homes offer a cost-effective, customizable, and safe housing option for a diverse range of people. With the real estate market evolving, manufactured homes are becoming an increasingly attractive choice for those looking to own a home that meets their needs and lifestyle. So, don’t let the myths deter you—explore the world of modern prefab living and discover the possibilities it offers in today’s real estate market, complete with a real estate MLS for mobile homes to help you find your dream property.

Can Lie Detector Tests Be Fooled? Techniques and Countermeasures

Lie detector test in London at Lie Detectors UK provide reliable results when determining whether a person is telling the truth. But can these tests be fooled by someone who is willing to deceive? The answer is yes, although several countermeasures can be taken to ensure accuracy.

A lie detector or polygraph test measures physiological responses such as blood pressure, breathing rate, heart rate and skin conductivity while the subject answers questions. By comparing these responses to those of normal subjects answering similar questions, an examiner can determine whether the subject is truthful. While this method can be quite accurate when administered properly, it can be fooled by those who know how to manipulate their physiological responses.

The most common technique used for fooling a lie detector test is called “countermeasure training.” This involves teaching people various techniques for controlling their body’s physiological responses in order to give false readings on the polygraph machine. These techniques may include relaxation exercises, controlled breathing techniques and muscle control methods. While these methods have been shown to work in some cases, they require extensive practice and are difficult for most people to master without proper instruction. Additionally, examiners who are trained in recognizing countermeasures will likely detect any attempts at deception on behalf of the subject.

Another technique used to fool a polygraph test is “deception overload.” This involves intentionally providing false information during the examination in order to overwhelm the examiner with data, which makes it harder for them to draw accurate conclusions about the veracity of the individual’s statements. However, experienced examiners can usually identify deception overload tactics due to certain patterns that emerge from this type of behavior, which contradict what would otherwise be expected from truthful individuals.

In addition to countermeasure training and deception overload tactics, other more extreme methods have been attempted in an attempt to defeat a polygraph test, including drugs designed to alter one’s physiology or even electroshock treatments administered immediately prior to the examination in order to disrupt the memory recall patterns associated with answering questions truthfully or falsely. Needless to say, these types of approaches carry significant risks and should only be considered when absolutely necessary, given the potential legal and medical consequences.

Finally, another way in which people try to avoid polygraph tests is by simply refusing to take them altogether, as refusal generally carries fewer legal consequences than actually lying during an examination (although, depending on why one would need to take such a test, refusal could still have certain consequences). Ultimately, however, refusals do nothing to help establish actual innocence, as no proof is provided either way, so caution must always be exercised when considering this approach, regardless of the context in which it might be applied.

Overall, several techniques are available for attempting to beat a polygraph test. Still, all ultimately come with varying levels of risk associated with them, ranging from minimal (such as refusal) all the way up to potentially life altering (such as the use of drugs). In any case however, it’s important to remember that even highly trained professionals administering examinations are still able to make mistakes so it’s always best to rely more heavily on facts rather than results alone whenever possible since no matter how good something like lie detectors UK might seem they will never be 100% accurate every single time!

The Ultimate Packing Hacks and Tips for a Smooth and Efficient Move with Movers in Plainfield

Moving can be overwhelming, especially if you are trying to tackle it alone. Movers in Plainfield, IL provide the best moving services that ensure a smooth and efficient move. But even the most experienced movers will tell you that packing is one of the most stressful parts of the entire moving process. Knowing how to pack your items properly is essential for ensuring that nothing gets lost or damaged during transport. Here are some great packing hacks and tips from Movers in Plainfield, IL so you can have a stress-free move!

Start Early

One of the best tips for having a successful move is to start planning ahead of time. You don’t want to wait until the last minute when everything must be done simultaneously. Give yourself plenty of time by starting early so you can plan out what needs to be done step by step. This will make packing much less stressful as things won’t pile up on each other all at once!

Gather Supplies

The next tip from our professional movers in Plainfield, IL is to gather supplies beforehand. Make sure you have enough boxes, tape, marker pens, bubble wrap and any other materials you may need before beginning your packing process. Having these supplies ready before starting will save you plenty of time later on down the line!

Pack Room by Room

When it comes to actually packing, it’s important not to get overwhelmed by the task. Break it down into manageable chunks by tackling one room at a time, rather than trying to do it all at once. This way, each room can be systematically packed without it immediately feeling like an insurmountable challenge!

Label everything clearly

One of the biggest mistakes many people make when moving is forgetting to label their boxes properly or not labelling them at all! Labelling clearly ensures that all your belongings end up where they belong after the move, which makes unpacking much easier later on! Markers should also be used where possible so that boxes containing fragile items are labelled as such – this will help to prevent accidents in transit!

Use clothing as padding

Items of clothing such as T-shirts or towels make great fillers and padding when packing fragile items such as crockery and glassware, as they provide extra cushioning against shock and impact during transport. It’s also a good idea to use clothing as extra padding between the legs of furniture when stacking – this will help prevent scratches or damage from rubbing together during transport!

Use smaller boxes

When packing heavier items such as books or tools, try to use smaller boxes instead of larger ones, as they are easier to carry than larger ones and will help prevent back or arm strain when loading everything into trucks or vans during transit!

Disassemble furniture

A final tip from our professional Plainfield, IL movers is to disassemble furniture whenever possible prior to loading it onto vehicles for transportation purposes – this helps to reduce size dimensions which allows for more space inside vehicles, making transportation easier overall! Additionally, removing screws from furniture frames can potentially save lives, as sharp edges can cause serious injury during the move!

Top 5 Strategies to Increase Facebook Views and Engagement

Are you looking for ways to boost your Facebook views and engagement? With billions of users around the world, the social media platform is a great way to reach out to your target audience. However, it can be challenging to make sure that enough people see your posts. You may want to consider leveraging additional tools and services to maximize your Facebook efforts. One such service that can help you increase your visibility and engagement is SocialZinger – check this service for effective strategies to enhance your Facebook presence. Here are five strategies, along with SocialZinger, that can help you get the most out of your efforts on Facebook.

1. Invest in Paid Ads

Investing in paid advertising is one of the best ways to increase visibility and engagement with potential followers on Facebook. You can leverage different ad formats such as carousel ads or videos, which will allow you to reach a wider range of people than organic content alone could do. Additionally, you can also take advantage of retargeting audiences if they have already engaged with your brand’s page or content in the past.

2. Leverage Visual Content

Visual content is an important part of increasing engagement on social media platforms such as Facebook. By using images, infographics, videos, GIFs, and live streaming features like Instagram Stories and Reels, you can create more engaging and interesting posts for viewers while still delivering useful information about your product or services. This helps draw attention from new followers while also giving existing ones something valuable to interact with.

3. Optimize Posts for Mobile Users

With more than half of all Facebook users accessing the platform through mobile devices, you must optimize your posts so they look good on any device type or screen size. Make sure that large images don’t cut off text or other visuals when viewed from a smartphone or tablet device, and always use high-quality photos instead of grainy ones from stock sites or low-resolution pictures taken with smartphone cameras.

4. Take Advantage Of User Generated Content (UGC)

User-generated content (UGC) involves leveraging customer-generated content rather than being created internally by yourself or someone else within your organization. This type of content provides an authentic way for customers to connect with each other and form relationships with brands they trust – which helps them be more likely to purchase products or services from them in the future! Adding UGC into marketing campaigns has been proven time and again to increase engagement significantly on social media channels like Facebook – so make sure not to miss out on this opportunity!

5. Utilize Influencers

Influencer marketing has become one of the most effective ways for businesses to reach their target audience online today – especially through platforms such as Instagram & YouTube, where influencers have gained millions upon millions of followers who trust their opinions & advice about anything related to products/services they promote! Leveraging influencers’ followings & credibility can help jumpstart awareness & engagement levels among those who may not have heard about your business before – so give this strategy a try if possible!

In conclusion, these are just some strategies that you should consider incorporating into your overall digital marketing strategy if you’re looking to increase views & engagement levels on social media networks such as Facebook! From investing in paid advertisements to utilizing influencers & user-generated content – there are many tactics available at our disposal today that we can use effectively depending on our individual needs & goals!